If you’re new to this newsletter, click here to access the rest of my newsletter articles such as the “Why We Passed on this Startup” series, reflections on investing, and tactics on winning in the market. Now, onto today’s post!

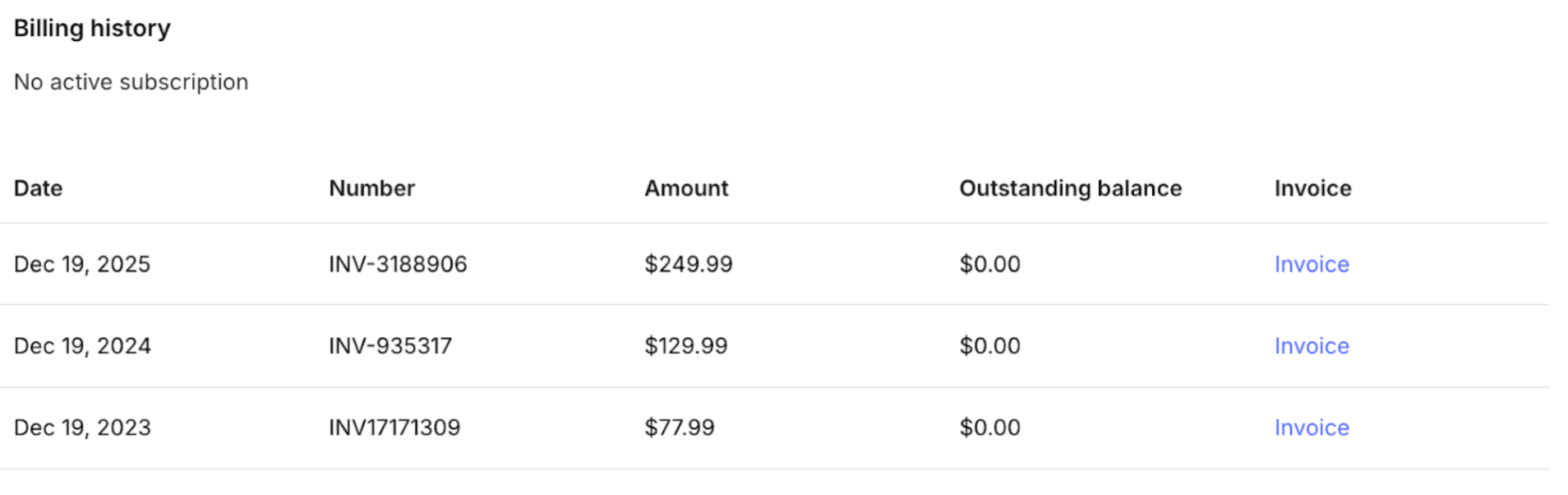

At the end of last year, a $249.99 charge hit my credit card that took me aback.

It was from Evernote, a note-taking app that I had used for years.

I hurried logged on to Evernote and what I saw below astounded me.

In 2023, Evernote charged $77.99 annually. In 2025, the company charged me $249.99 annually. A price increase of three and a half fold in two years… for virtually the same functionality and experience.

Now, truth be told - the company told me this charge was occurring a few weeks prior. They in fact sent me an email telling me this was going to happen. But in the midst of Christmas, I honestly forgot.

What stood out to me was not the fact that I had forgotten the charge, which I assumed I could get refunded.

But also that something was clearly amiss with the company.

When a company increases prices 3.5x fold in two years… something more is happening. Unfortunately for Evernote, something was amiss for many years.

This radical price increase was not just a point it time snapshot. It was rather another punctuation mark of a very unfortunate startup story that neither the CEO, nor the VCs that invested $247 million, were clued in on.

That I what I want to clue you in on now.

The Value of Evernote

Evernote was literally one of my favorite tech products for many years.

I first started with Evernote in 2015. I was starting business school at Indiana University and wanted to move my note-taking from a fragmented series of Word documents that I had in college to a living-breathing panorama of insights that I could carry in my pocket.

Evernote was that for me.

I still remember my “a ha” moment of annotating a PDF. I would read through the PDFs that my professors would send me through business school. Using Evernote, I could highlight sections that I deemed important.

Then, Evernote would set the front section of the PDF for all of the highlights that I made so I could quickly reference them each time.

My behavior with the app showed its vitality to my everyday life. It quickly became an app that I moved to the front of my iPhone home screen and on the dock of my MacBook Pro.

It also became a repository of my reflections over the years of building my FinTech startup and what I could have done differently, etc. I really loved using Evernote.

While I was less in touch with startups and VC news at that time, Evernote was tearing it up on the growth and user acquisition side.

The First Funding Rounds

The first early funding rounds of Series A, Series B, and Series C rounds included $10M and $20M from Sequoia in 2010.

In 2011, Evernote raised a Series C and in 2012, Evernote raised a Series D, valuing the company at $1 billion. Also in 2012, it raised another Series D of $85 million.

The total funding of Evernote stood at $247 million, according to the Wall Street Journal. The WSJ headline read that “Evernote raises another $85 million at a $1.1 billion valuation to become the “‘World's Brain.’”

The Evernote CEO, touted in an interview that the company would be around for 100 years. These are the kind of stories that we expect Silicon Valley's success is built off of.

The “World’s Brain” Starts to Leak Fluid

Yet, in the mid to late 2010s, the “World's Brain” started to leak fluid.

I see two major undetected tears on the brain that were lingering under the surface of the membrane of the company.

1) The Freemium Business Model that Couldn’t Convert at Scale

2) Category that Became a Commodity, Fast

Tear #1 - The Freemium Business Model that Couldn’t Convert at Scale

Evernote's main business model was a freemium model. this is when a company would acquire users for free and then over time look to upsell and convert those free users to paid users.

The Freemium business model's advantage is that, because everybody can enter for no cost, growth is quick and fast.

Yet, the freemium business model is predicated on not optimizing for the entry point but rather for the longevity and usage of the customer.

The freemium business model can be a helpful and strong business model, but only under very strict conditions:

1) There needs to be a very clear and compelling reason to upgrade to paid.

2) The pricing tiers need to be done incredibly thoughtfully and in line with customer behavior.

Specifically, pricing tiers that I see done well tend to be anchored in limits on features, not access to features themselves, as we will see that Evernote started with.

The third reason is probably the most important for freemium.

3) I also do not believe that freemium works in many markets. Consumers are very finicky and the barrier to entry is typically extremely low.

In the case of Evernote, their freemium model allows them to scale incredibly rapidly.

When I signed up for Evernote in 2015, I specifically recall being surprised on the sign up and usage of Evernote that I was getting a pretty good deal getting all of this functionality for no charge at all. It was like this zen state of not charging for something that really was valuable to me.

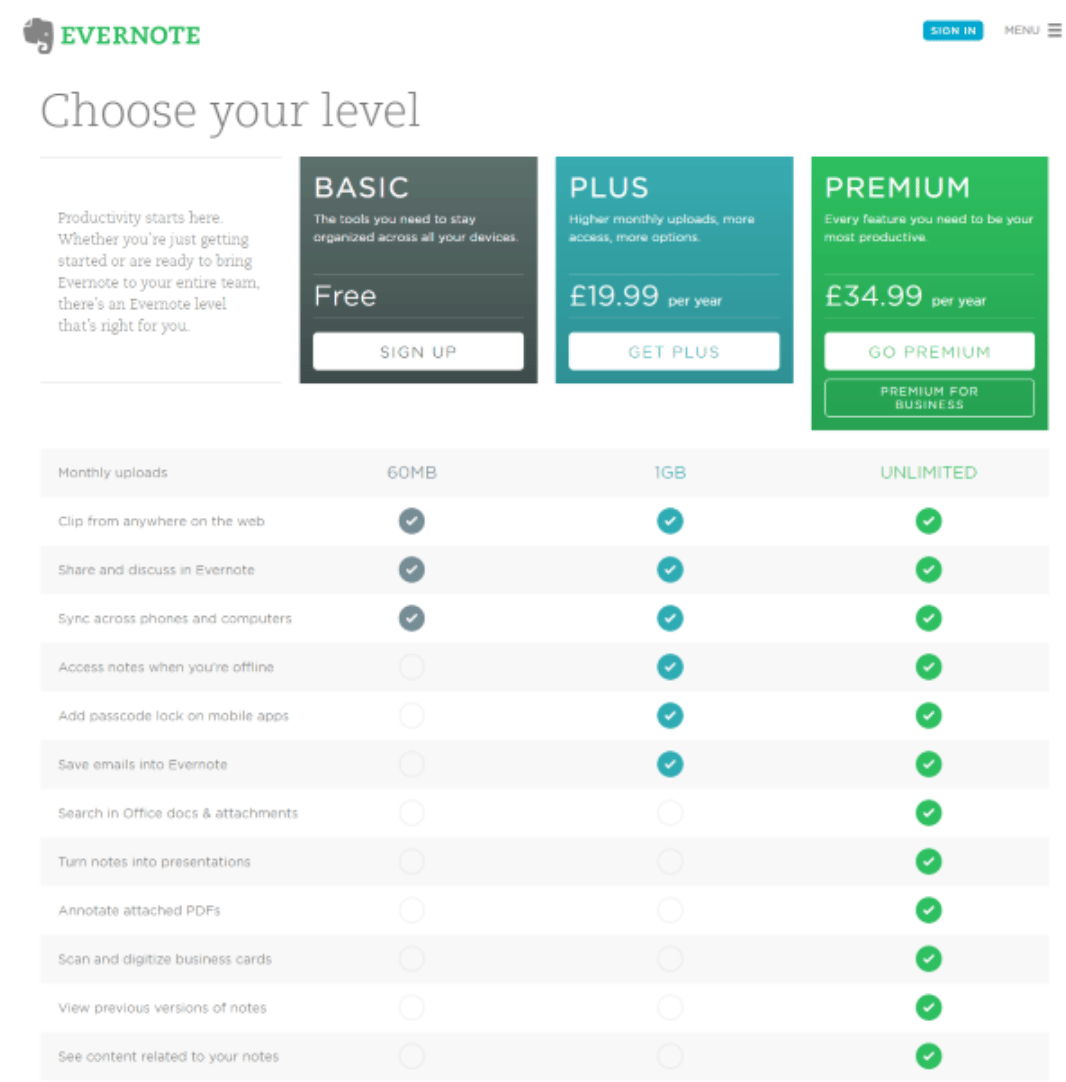

Evernote did end up introducing tiers on their pricing in 2015. I stayed on the free for as long as I could and then I upgraded to premium.

Below are the pricing tiers for Evernote in the early days.

The reports of user counts that I have researched differ, but Evernote absolutely had tens and tens of millions of users in the mid-2010s.

But conversion from free to paid was very low. Terribly low.

The freemium business model, the high user growth, attractive massive amounts of venture capital. But this high flying growth cloaked what I see as the deeper tear on why conversion to paid was so abysmal for Evernote.

Tear #2 - Evernote Played in A Category that Became Commodity, Fast

I have a friend that once had a note-taking startup. She bootstrapped his company and learned a lesson - the same lesson that took Evernote $247 million in venture capital to figure out.

That is, the core job-to-be-done of taking notes is a commodity category. As such, Evernote’s core functionality was difficult to monetize.

As technology evolved in the 2010s, note taking became so bare-bones fundamental to the digital age, that I believe that the consumer adopted this inherent unwillingness to pay for such a service.

Note taking and list building also were not some technological marvel that was difficult to achieve. It was very prosaic.

It was akin to charging for a bottle of water. I don't want to pay for water because I could just go find a drinking fountain somewhere else.

To further this point, I interviewed my friend about the startup and their experience. Notice how Alexandra learned lessons that it took Evernote $247 million to learn.

My Friend’s Account of the Commodity Category

At one point, my friend Alexandra acquired a startup whose core functionality was in note taking and to-do list building.

This startup was an underutilized asset - the founder wasn’t doing much with it.

Upon its acquisition, the startup had tens of thousands of users. The hypothesis was that they could scale the user base, and eventually sell the startup for a higher price.

Several months before they acquired the startup, the business changed their revenue model from $5 a month to $16 a month with little impact on customer churn. A good signal.

The startup had some strong digital assets - they had very strong SEO. They had highly ranked pages that were receiving a lot of web traffic.

The product had some obvious bugs, and at the time, it had very bad conversion from free to paid - well below 1%, according to Alexandra.

But things started to not click as readily as Alexandra hoped.

Over time, Alexandra made some discoveries:

They learned from customer feedback that if customers were going to pay money for a product like this, they were going to shop around.

They also discovered the product itself was actually quite bad without a compelling feature set. It had been marketed very well to get inbound traffic, but the product itself didn’t keep customers in.

The expectations on a consumer product are really high, lots of pricing shopping, product hopping. She also noted, “When customers would cancel, we had a feedback request… we didn’t get much feedback.” Thus, there is a fickleness of customers that didn’t possess any loyalty on the product.

In addition, in a consumer app, you need to be cross-platform - desktop app, mobile app, they were shipping updates to the web but the mobile app was busted and written in archaic code base so they couldn’t address much with the mobile.

Additionally, my friend blamed the category, saying, “You look at the landscape - Coda, Notion, DropBox, Google Docs, it’s all converging on the same feature set. It’s a race to the bottom.”

My friend Alexandra discovered at a very micro-scale what Evernote discovered but raised $247 million to do so.

Evernote’s Recent Moves

The World’s Brain bleed couldn’t continue.

In November 2022, Italian app developer Bending Spoons S.p.A. agreed to buy Evernote, with the deal closing in January 2023.

Bending Spoons is an Italian technology company that is known for acquiring and operating digital products with existing market traction rather than building new ventures from scratch.

Regarding Evernote,

Bending Spoons laid off a significant portion of Evernote’s staff in early 2023, saying the business had been “unprofitable for years.” (no really?!)

So in the last two years, Evernote had been under the management of Bending Spoons.

Closing Thoughts

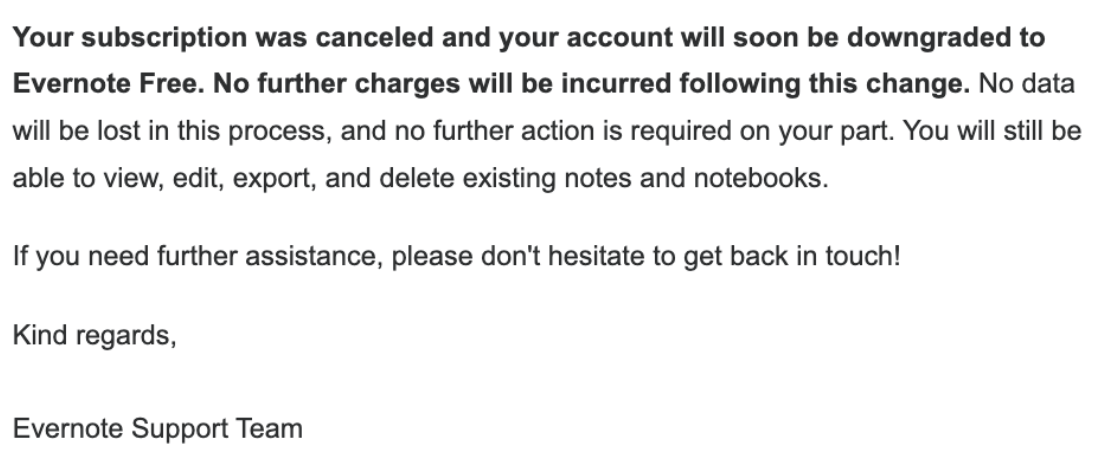

Let me go back to that hurried moment when I discovered the $249.99 charge on my credit card. When I went to cancel my Evernote subscription and request a refund. I received this email reply:

I found it funny that the message mentioned I could export my existing notes and workbooks. It gave me the impression that they welcomed me to do so, as if it read, “If you want to take your data and move to another platform, go ahead!”

So, I did find a different solution, Zoho Notebook. Surprisingly, or unsurprisingly given the low barriers to entry of the space, Zoho had built an integration to grab Evernote’s data.

When it was all said and done, Zoho automatically migrated 10 years of thousands of my notes from Evernote onto another platform in just a few hours.

Just another clear signal of how neither the CEO, nor the investors, thought about the World’s Brain as playing in a commodity category.

A price increase of 3.5x isn’t going to fix that fundamental market issue.

Click here to access the rest of the newsletter articles.

Here are some of the recent ones!