If you’re new to this newsletter, click here to access the rest of my newsletter articles such as the “Why We Passed on this Startup” series, reflections on investing, and tactics on winning in the market. Now, onto today’s post!

Sending monthly investor updates was one of the best decisions I made as a startup founder.

Now, as a founder, creating and sending investor updates was one of a million items on my punch list.

But I’m going to share how the consistency of monthly investor updates created incredible leverage and proved to be my secret weapon for network connections.

I’ll also share several tactics on how I’d recommend executing on investor updates from my founder turned investor perspective.

When I founded my FinTech startup, investors updates were not on my radar screen.

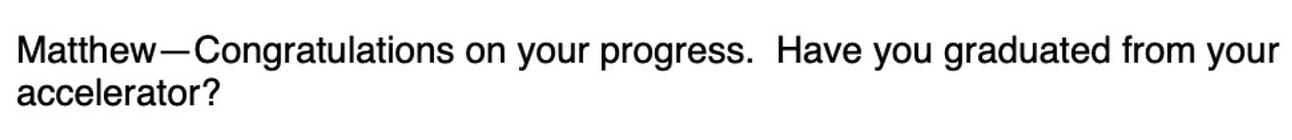

The first time that I heard about concept of investor updates was through the startup accelerator, gBeta. I had an amazing experience on so many levels that is too vast to cover here. My cohort was led by Abby Kursel and Maggie Brickerman, Partners at Gener8tor. Abby and Maggie emphasized the importance of sending these updates on a monthly basis.

At that time I went through the gBeta accelerator, I didn’t have any investors on my cap table. But I was constantly meeting new people - investors, potential customers, service providers, advisors, etc. For me, these updates were more like “follower updates” - people who I had encountered in my startup journey.

In April 2017, I decided to commit to sending monthly investor updates. I stuck with it, month after month. Here is what I found after doing this for the next two years of my startup journey:

✅ Monthly updates take the long tail of ongoing connections the startup is continually making and turn it into a long tail of ongoing value. ✅

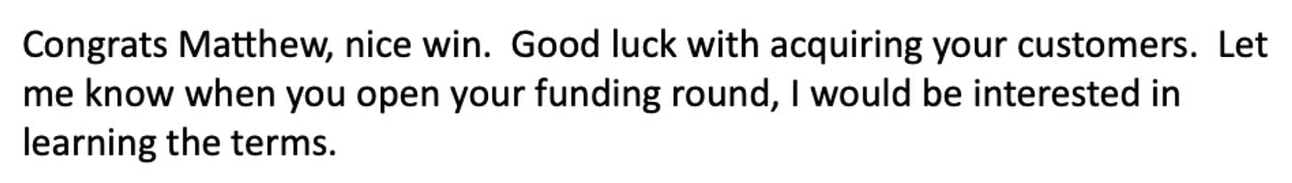

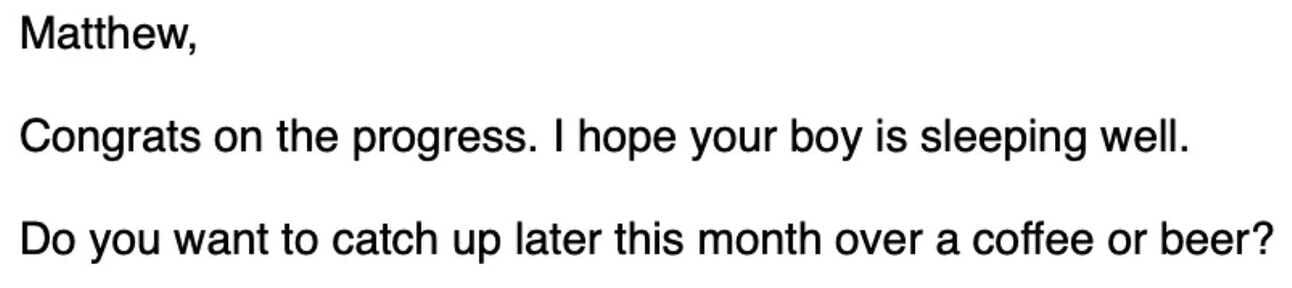

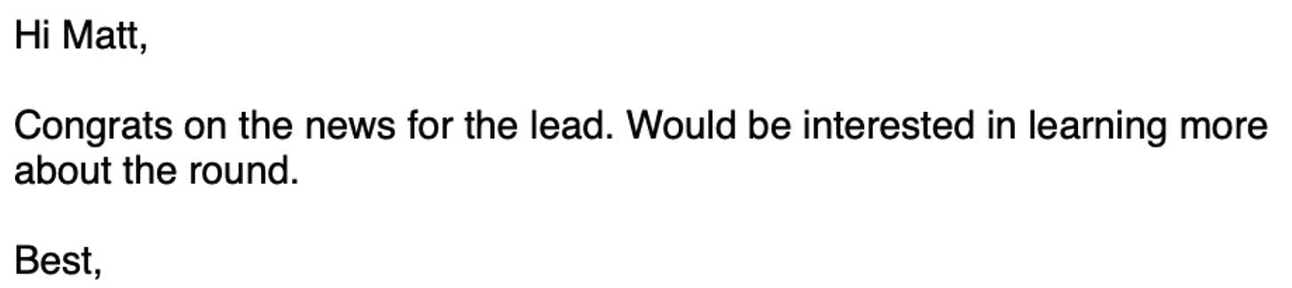

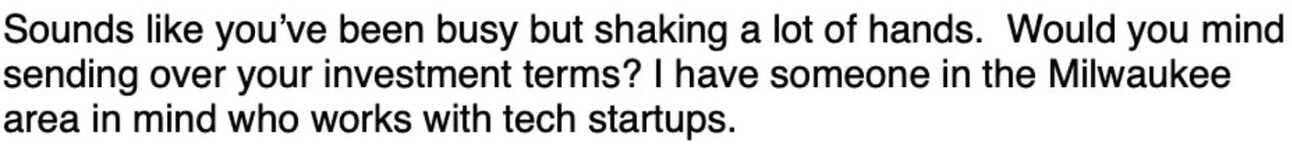

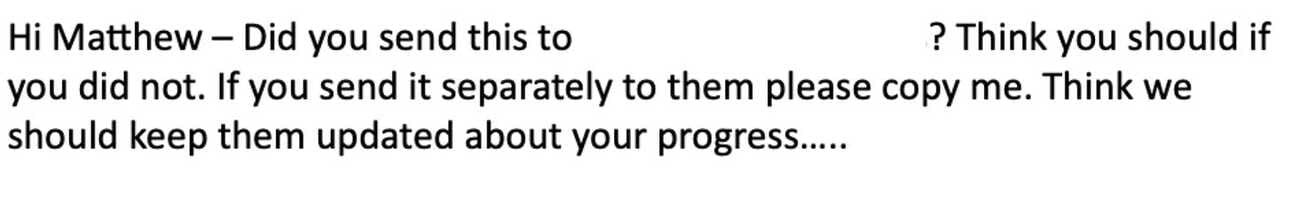

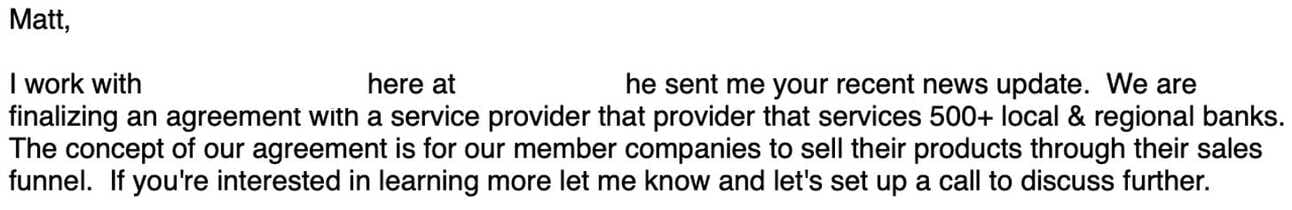

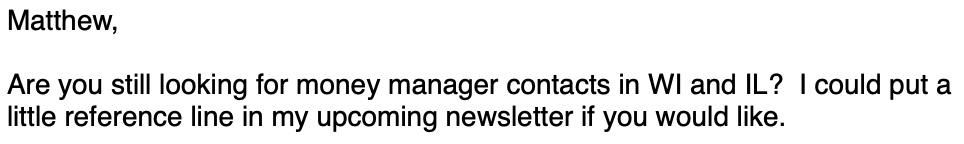

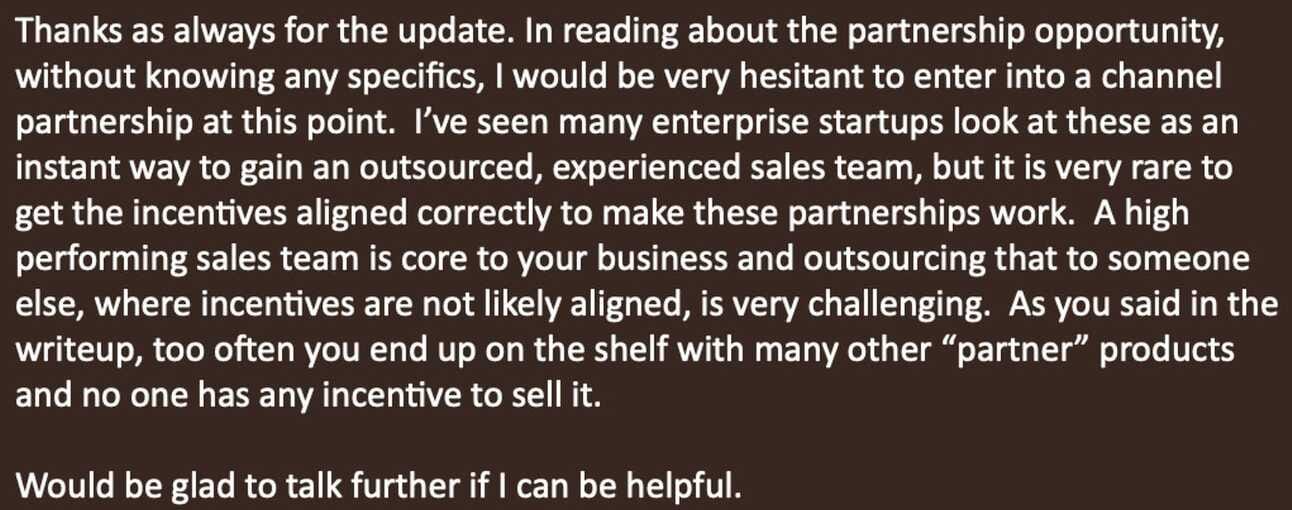

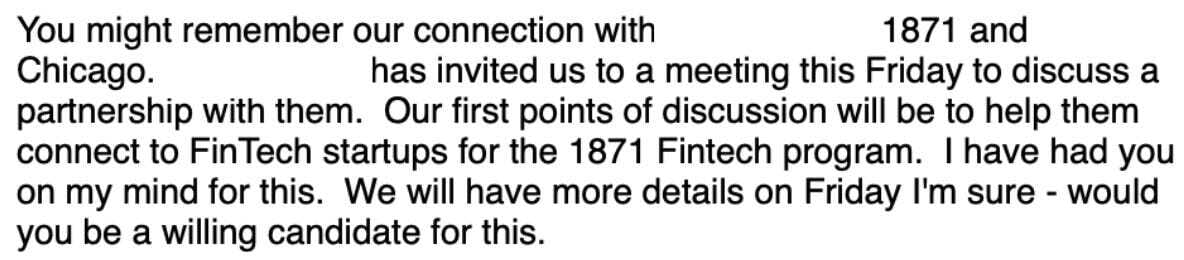

I went through my email archives this past week and dug out some of the amazing nuggets of value. These are just a small sample of some of the ones that I found! I recall having 2-4 responses per email monthly update that I would send.

The responses fell across three major points of value three points of value…

1) Monthly Updates Activate Investors

2) Monthly Updates Activate Potential Customers

3) Monthly Updates Activate Emotional Fuel

Why Sending Monthly Updates Works

✅ An updated investor is an activated investor. ✅

An investor update gives the investor a reason to think about the startup and founding team. When they think about you, they make connections about you. Your email makes responding very easy with a thought, suggestion, or a connection.

✅ A startup’s goal should be to maximize top of mind awareness with those following their journey. ✅

Four Tactics for Strong Investor Updates

1) Commit to Monthly Updates

The only reason I had so much engagement in the screenshots above was because I sent monthly updates. That’s it. I wasn’t saying anything super profound.

The consistency of the monthly cadence spoke for itself.

Now, in my investor experience,

Lots of startups don’t send updates at any specified frequency.

Lots of startups send quarterly updates.

Very few startups send monthly updates.

✅ There is a dramatic difference between quarterly and monthly updates. ✅

Through my experience running Tundra Angels, the members/investors feel the most engaged with the portfolio companies that send monthly investor updates.

When those companies come back for follow on funding, where do you think those investors’ heads will be at?

Quarterly updates, I’ve seen, are the minimum expectation no matter angel investor or VC. No investor is necessarily impressed with a quarterly update. They appreciate it, but that’s the minimum expectation.

Why Monthly Updates are a Competitive Edge

Monthly updates, on the other hand, send a signal. Monthly updates convey that the founding team cares about those following along on the journey. It shows the founders see that a long-tail of mutual value exists from those who are supporting them and following along.

On a practical level, there is WAY too much happening on a monthly basis that a quarterly update is grossly inadequate.

As a founder, I saw that consistency of my investor updates was one vantage point into my execution. As an investor, I can attest that is the case in receiving investor updates.

2) Use a Mail Delivery Platform to Send the Updates

Using mail delivery service platforms (Mailchimp, Hubspot, etc.), founders can track open rates, number of opens and from whom, click-through rates, etc.

This data gives founders unique insights without them ever having to ask directly - which investors seems to care about what we’re doing, and which ones don’t? Now, this isn’t fool proof. But it may give an indication to see which investors or followers are uniquely interested in your journey.

In my startup, I used MailChimp. For Tundra Angels, I send monthly updates to potential Tundra Angels investors via Hubspot email distribution.

Many startups BCC their email distribution list for their investor updates. I think that’s a missed opportunity. Startups need to savor the insights to know who is looking at the updates, how often they are looking at then, and be able to act on those insights at the appropriate time.

3) Commit to a specific time at the end/beginning of the month

Block out on your calendar 1.5 hours to knock this out. Set a calendar appointment that cannot be overridden.

When you think about time spent vs. value received, this will be one of your best decisions.

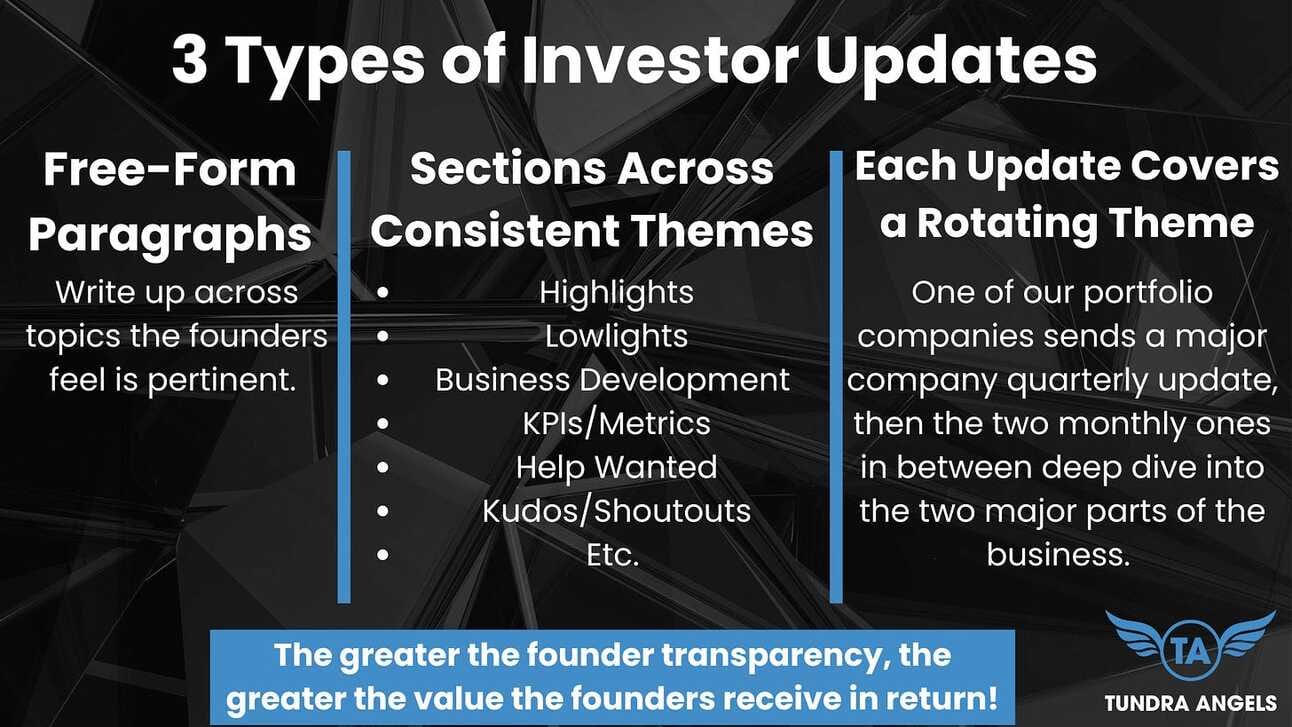

4) Use a Template for Efficiency

Founders need to templatize their monthly updates for consistency and readability. Your audience will start building patterns of how you organize your updates. Don’t be jagged and random.

Here are three examples of templates that I’ve seen:

Closing Thoughts

✅ Monthly updates take the long tail of ongoing connections the startup is continually making and turn it into a long tail of ongoing value. ✅

Founders have spent years of their life building the contact names and network in their CRM. The question becomes, how should a startup best leverage them?

I believe that monthly investor updates are the best way to do that.

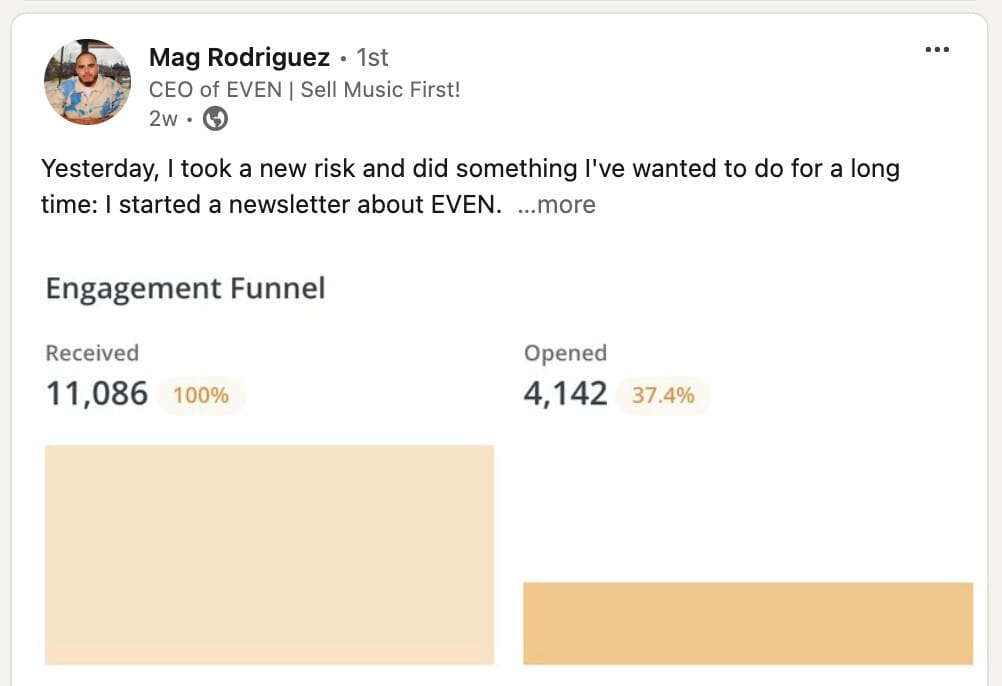

Let me close with a screenshot of a LinkedIn post from Mag Rodriguez, Founder and CEO of EVEN…

Check out his post to see some of the amazing results that he achieved from this investor update.

Monthly investor updates have this way of leverage arbitrage. The payoff is well worth the very small monthly commitment to do this.

Because an updated investor is an activated investor.

Click here to access the rest of the newsletter articles.

Here are some of the recent ones!