If you’re new to this newsletter, click here to access the rest of my newsletter articles such as the “Why We Passed on this Startup” series, reflections on investing, and tactics on winning in the market. Now, onto today’s post!

I had to laugh. The irony in the last several weeks was super apparent.

Three individuals recently told me different views on TAM (total addressable market).

I had a conversation with a VC where we were exchanging potential startup deals. For one particular startup, the investor told me that they passed on a particular startup because they couldn’t get comfortable with the size of the market.

I also read an article about Dylan Rimer of Index Ventures who said that, “We really view TAM as noise.” (By the way, this was later, after he did a TAM analysis on AirBnB and ended up passing on it). Good thing he learned his lesson enough to invest in Figma.

And then I had a VC-backed startup founder tell me, “Our market is opening up to us. But yet we have potential investors who all the time are unsure about our TAM.”

My Struggle with TAM

TAM is one facet within founders and VCs that doesn’t have a strong consensus. But here is what I’ve seen:

How an investor views the importance of TAM affects how they invest or do not invest.

I have a hard time when investors mention market size as their pass reason. I think TAM can become an easy excuse to say no to a startup. I’m not saying it always is, but it’s a relatively convenient one.

Now, a big market is important, and I will share more on that later. But the size of the market that the startup enters on Day 1 is irrelevant, in my opinion.

I struggle with TAM, Total Addressable Market, for two reasons:

1) A TAM Analysis is a Snapshot in Time

It’s a snapshot of what the market looks like right now and does not include the understanding of what actually is one of the change agents of a market - the startup itself.

It is the startup whose influence over the market over time shapes and defines the future of the market and its size.

Thus, looking at a point in time today of the supposed total addressable market is quite fruitless to base an investment decision on.

2) Focusing on TAM is Detrimental to Strategy

I’ve seen that focusing on TAM is highly, highly detrimental to both sound startup execution and startup investing strategy.

There is this myth among investors that a larger market can bring opportunity - new customers and revenue - very quickly. So VCs tell startup founders, “We invest in big markets. So go take on that market.”

But I think that founders and both investors underestimate how much a larger market can take it to the startup.

Launching into a large market on Day 1 is actually the complete opposite of sound startup strategy. Startup progress happens by tipping the scales of smaller markets in the startups favor along the way.

Key Insight

✅ It’s not about the size of the market, but rather about your startup being the fixture of your customers’ attention. ✅

In a large market, there will be too many competitors that there will be blood in the water. Other startups enter in and will seek to grab a piece of the attention. It is impossible to be the fixture of your customers’ attention in this context.

But in a much smaller market, it is much different. Yes, there are likely far less customers than if the startup were to enter a large market out of the gate. However, in a much smaller market, there is ideally zero competition in trying to acquire those customers.

The prospect is not comparing you with another startup that does something similar. Rather, your startup is the only choice. The prospect either acts on it, or they don’t.

Importantly, the likelihood of a prospect acting on something with you goes up exponentially when there is only one option to choose from.

✅ Every startup needs to start in a small enough market where their startup is the one and only. ✅

Reframing TAM to FAM

So I’d like to reframe TAM in a way that actually is additive to the startup and its potential investors.

I’m reframing TAM to FAM.

✅ “Fixed Attention Market” - the smallest market where the startup can be the sole fixture of the customers’ attention. ✅

Because, fundamentally, fixed customer attention is what drives success, the size of the market is much more downstream.

This concept of starting in a small enough market where the startup is the one and only is challenging for investors who believe TAM is highly important in decision making.

Because if a VC (or even a founder) is focused on TAM, it will be a complete fake out for the investor when a startup is operating in a very small market.

Without this lens of thinking, the investor will think that the TAM is too small and may pass.

Where what they should really see is, “Can this smaller market unlock larger and larger markets along the way?

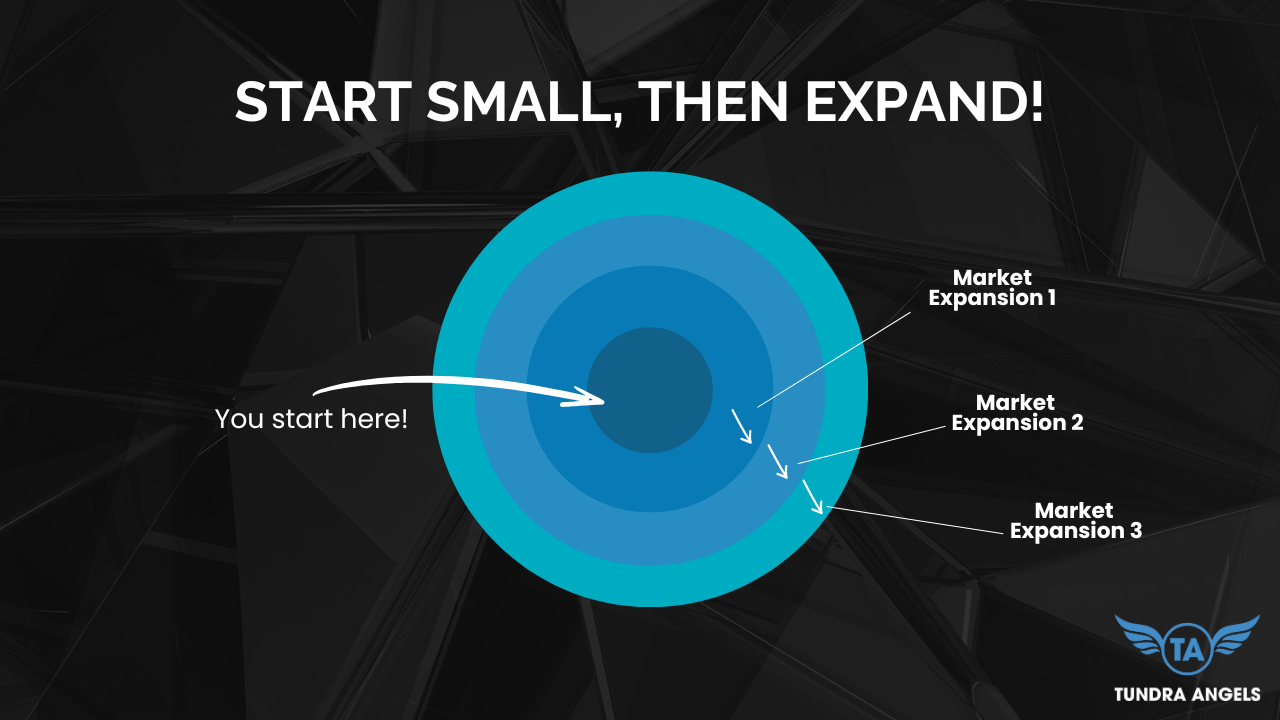

Here is a simple graphic that shows that it’s not about TAM on Day 1, but rather the niche markets that they tip on the way to the broader, mass market.

Now, this way of thinking isn’t just my words, it's the words of Peter Thiel as well. I linked a two minute clip where Thiel shares more insights on this.

So Does TAM not Matter?

Maybe?? Kind of?

Frankly, my take on TAM right now is a simple question, “Is it big enough?”

Big enough means simply that will this market and its revenue potential be interesting enough to a potential acquirer to want badly enough that it wants to add those economics to its financial statements?

Besides that, I don’t fuss about TAM too much.

But again, it’s not about the snapshot in time. It’s about the future that the startup is building will define and shape the market.

Closing Thoughts

TAM is one facet of VCs that doesn’t have a strong consensus.

But emphasizing TAM is actually nonsensical because it is the startup that defines and shapes the market, and it is also detrimental to startup execution and investing strategy.

Startup progress happens by tipping the scales of smaller markets in the startups favor along the way.

It’s not about the size of the market, but rather about your startup being the fixture of your customers’ attention - in whatever market size you are in.

It’s not about TAM. It’s about FAM - fixed attention market - the smallest market where the startup can be the sole fixture of the customers’ attention.

Can this smaller market unlock larger and larger markets along the way?

Are you in a market that will take it to you?

Or will you take it to the market - where you can own the fixed attention of your customers by being the one and only?

So, where is your FAM?

Click here to access the rest of the newsletter articles.

Here are some of the recent ones!