If you’re new to this newsletter, click here to access the rest of my newsletter articles such as the “Why We Passed on this Startup” series, reflections on investing, and tactics on winning in the market. Now, onto today’s post!

I enjoy trying to create order and frameworks out of what otherwise seems as haphazard and variable.

Yet, there are some things in startups that have SO much variability, it is difficult to pin down a framework around it.

For a long time, I assumed that business models were one of those major variables. I believed that there were so many business models out there, that is was difficult to pin down.

But then I discovered a valuable piece of content that changed everything for me, and I wanted to share it with you here.

The Simplicity of the 9 Types of Business Models

I came across an article from Y Combinator which broke down all startup business models into 9 types of business models. I wanted to share those 9 types with you here.

Continually, as an investor, I see unique business models applied to different industries.

✅ Here is what I have found - the startup with the superior business model wins.

I believe that business models are one of the most underutilized opportunities in startups. ✅

Additionally, startups are an incredible art form. The beauty of startups is that there is no limit to creativity that can be applied.

You can see these nine types of business models similar to the palate of a painter, or the musical staff and notes for a composer.

Done exceptionally well, if a startup has the right business model, it effectively harmonizes market tension among one actor or several actors in the market.

It allows the market to sing in four-part harmony.

Here are the 9 Types of Business Models,

SaaS

Enterprise

Usage-Based

Subscription

Transactional

Marketplace

E-Commerce

Advertising

Hardware

Let’s get into it.

1) Software as a Service (SaaS)

Cloud-based subscription software

The way that I view a SaaS business model is that often the software can be purchased by credit card by one or two people in an organization.

Typically, pricing-wise, we tend to be talking about a product that is single digits to four digits in revenue sizes on a monthly or annual basis.

2) Enterprise

This is when a startup sells a large software contract to a large company. Typically seen as five or six figure, or even seven figure annual contracts

Importantly, both SaaS and Enterprise are often subscriptions for software.

In the way that I view it, a SaaS business model often can be purchased by credit card by one or two people in an organization. It becomes an Enterprise sale when the contract value is so large and there is a depth of implementation required that the prospect requires decisions by committee. Contracts often need to be viewed by the internal legal team and get clearance from the IT team. The trade off is that it is a higher contact value but the trade off is the sales cycle length.

As a company matures, a startup company often has both a SaaS and an enterprise sales motion in place.

3) Usage‑Based

This is a pay-as-you-go model that is based on consumption.

In this business model, there is typically a singular usage-metric that the startup’s product hinges on. In the case of AWS, it is based on compute used. In the case of Zapier, it is based on the number of “Zaps,” i.e. API calls that are made. In the case of DropBox, it is based on gigabytes used.

4) Subscription

This is when users pay regularly, on a monthly or yearly basis, to access a digital product or service. (e.g., Slack, Netflix).

5) Transactional:

When startups make money by facilitating a transaction and taking a small cut.

This is when startups make money by facilitating a transaction. It could be buying, selling, booking, or bidding, and taking a cut.

The startup benefits directly from every transaction, and growth is exponential as more participants drive more volume.

This type of business model is important when there is a lot of monetary volume flowing through the infrastructure of the startup, and the startup takes a small clip.

To be successful, it is about being a dam on a very large river. The startup has built infrastructure, i.e. a dam, that monetizes the flow of the river.

6. Marketplace

The marketplace business model connects buyers and sellers on a platform and earns fees on the transaction.

Note, the marketplace and transactional models have some similarities, especially as sometimes both take a percentage fee of the transaction. However, I distinguish between the two in that a marketplace does the work of connecting two parties who learn about each other for the purpose of making a transaction. Often, a transactional business model does not do the work of connecting buyers and sellers for the purpose of the transaction.

7. E-Commerce

Sell products online

E-commerce often exists as a single-product or portfolio of product-company that sells either B2C or B2B.

8. Advertising

Advertising is when a startup offers free content or services and then monetizes the attention on the platform by selling to advertisers.

To be successful in this business model, the startup needs to capture (and retain) attention in the order of millions of people for the model to be highly lucrative.

Thus, even though major platforms such as Instagram, Snapchat, Meta, Reddit, are successful in advertising.

What you may find interesting is that I talked to a number of founders often over the years that tell me that they are going to use advertising as a business model.

When I ask them how they are going to get from a couple hundred users to a couple million, they do not have a good answer.

There is a finite amount of attention. So it’s not just grabbing a few hundred thousand to a million users. It is stealing them away from other things.

Thus, I have come to believe that the advertising business model is one of the easiest ones to reason, but one of the most difficult of all to get right.

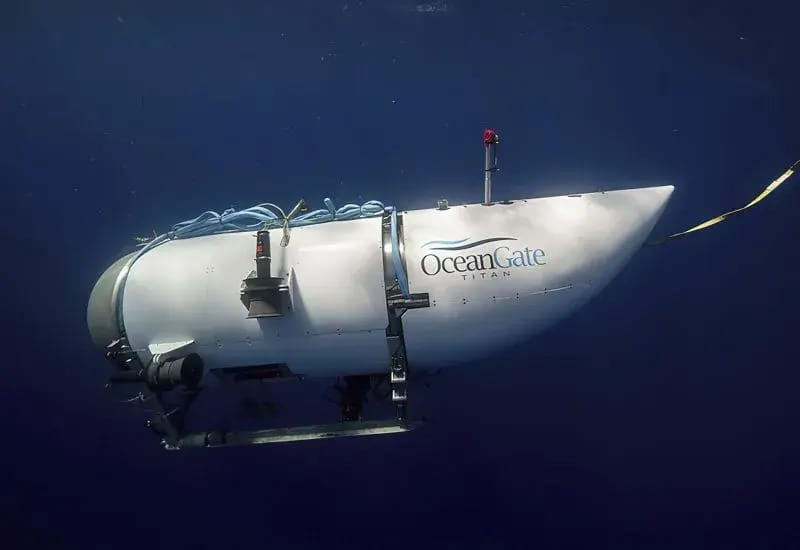

9. Hardtech/Bio/Moonshots:

Then, there are some business models that are so futuristic that it represents an enormous change in a given industry.

This may be software only, or have a software layer. But, software is not necessarily required.

I also want to point out that it is easy to think that a Moonshot business model is higher risk than other business models. But that is actually overly simplistic.

It is largely industry-dependent. The right technology, for a market that is ripe for it and there are incumbents who will not do it, is actually a lower risk venture than other software only ventures where there are hosts of competitive products.

Story from 23 and Me

Startups can have multiple business models over time, but they often start with one core business model.

Startups get into vast amounts of trouble when they layer a second business model if their first business model is a shaky foundation.

23 and Me can understand your family ancestry from your DNA. That's really cool at face value.

To use 23 and Me’s product, consumers needed to take a DNA test that they sold e-commerce.

However, consumers only needed to take the test once, and then they had no need to re-purchase a test. Hence, there is no repeatability to 23 and Me's DNA test business model.

And yet, subscription businesses, or repeat customers for non-tech businesses, are the foundation of all strong businesses. So, 23 and Me unlocked a cool feature in a one-time transaction that never needs to be repeated?

Purchase growth dropped off. The growth of 23 and Me had stagnated.

Then, 23 and Me tried to move from this poor foundation of a non-repeatable e-commerce business model to attempt a business model all together - using DNA data for health reasons and to develop therapeutics.

But, efforts like this require continual data inputs of data over time. But the flaw is that 23 and Me’s previous model was a one-time test. It’s hard to get a continue stream of data from millions of one-time tests at scale.

The final fatal flaw for 23 and Me was that they layered a second business model on top of a shaky foundation of their first business model.

How Investors View Business Models

Investors oftentimes tend to set up investment thesis by the business model.

For example, when I have meet and greet chats with investors, often times they use the language of a few business models to describe their thesis.

They might say, "We only invest in B2B SaaS companies that are X, Y, or Z. Or, we only invest in DeepTech (implying largely moonshot opportunities), or we invest in marketplaces or SaaS companies.”

Why Do Business Models Matter to Investors?

In a word, defensibility. Defensibility is the ability to hold your pricing power in the market. Alternatives will inevitably come into your space. A startup that is strongly defensible has the ability to maintain their pricing power, as opposed to a poorly defensible startup who is more of a commodity that needs to flex its price to remain relevant.

Personally, I see it this way:

✅ Business models are tactics to occupy different amounts of surface area across the problem dynamic. ✅

Typically, but not always, when a startup occupies more surface area of the problem, generally that means that there is more defensibility.

To quote another article that I wrote, a business model is often one of the main reasons that an incumbent will want to pick up the castle, rather than re-route the startup’s moat.

Closing Thoughts

You can see these nine types of business models similar to the palate of a painter, or the musical staff and notes for a composer.

Ultimately, business models are tools in the founder’s toolkit to align pricing with value.

As startups is an art form, Business models are on the palate of the founder to paint a work that the market will see as a masterpiece.

Click here to access the rest of the newsletter articles.

Here are some of the recent ones!