If you’re new to this newsletter, click here to access the rest of my newsletter articles such as the “Why We Passed on this Startup” series, reflections on investing, and tactics on winning in the market. Now, onto today’s post!

It’s been five years since the founding of Tundra Angels. Over the last five years, we have over $5M deployed in 23 startups. I wanted to write a post about reflecting on those five years that I hope is helpful to not only founders but also investors.

At one point, one of my investor contacts once told me something that took me aback. Tundra Angels had been around for a number of years by that point.

The investor told me, “When Tundra Angels invests, it means something.”

Whoa.

I was overjoyed to hear this passing comment. I was super grateful to hear this from this investor friend. It validated the several years that I had spent building the brand until that point. It validated that the intentional brand building was starting to accomplish what it was intended to do.

Over time, I have gone back to that investor’s comment. After five years of founding Tundra Angels, our aim is that this will statement always be true. But that it will mean even more to as the years go on.

The Audacious Goal

I see our job simply put as this - Tundra Angels’ goal is to invest in the index of the best startups in Wisconsin.

If there were to be such an index, the aim is the companies in that index would also be portfolio companies of Tundra Angels.

As I reflect on the five years of Tundra Angels, many of the success that we have seen is by design.

To be transparent, and to help other founders and investors, I wanted to lay out some of the key decisions that I have seen have helped power our success thus far.

A Full Time Manager and a Younger Generation of Investors

What I have seen is that Tundra Angels tends to be an anomaly among angel investor networks in one way - I do Tundra Angels full time. One of my advisors, who runs a very successful angel investor network, once told me,

“Of the [angel investor] groups that have been around a long time, move a good amount of investment dollars, run professionally, do good diligence, have good returns, provide a good member experience and a good entrepreneur experience nearly 100% pay their manager as close to a market wage as they can.”

Because of that, I decided that I owed it to our investors for Tundra Angels to become my full time effort.

Furthermore, an important part of venture capital investing is speed. Speed to get into a deal, especially when it's closing in a short period of time.Opportunity doesn’t wait. So being able to focus on the pulse of the market full time has been one of our key advantages.

With some of our top performing portfolio companies, we went from group pitch to close in less than 3 weeks.

Now, we typically don’t aim to close deals this quickly. But it was simply a matter of timing on where the company’s round was relative to when we got connected.

My full time dedication to this role allows us to move, and move quickly.

Another key decision that we made is to intentionally focus on who we defined as our “ideal investor profile.”

Thus, we optimized for the key metric of hunger and tenacity. We specifically identified current CEOs, Presidents, and Executives that were current operators of their companies, with an age in 30s, 40s, and early 50s. Our hypothesis was that there is a hunger and vibe from individuals who are currently taking risk in their own companies, and then channel that same hunger and drive to investing in and working in startups. Now, life stage is not the perfect metric for hunger and engagement, as we have a host of individuals who are retired and bring this same tenacity. It really is about optimizing for the tenacity of the individual. This strong emphasis has allowed us to welcome in very strong members, and also mutually walk away from members who don’t have the right level of Tundra Angels hunger.

And it shows.

After every pitch meeting, we get super positive feedback from the founders that pitch - about the venue, about the experience, about the investors and their questions, about the connections that different investors made with them, etc.

It’s a 360 degree experience that helps each founder feel that we are coming alongside them - even if it ends up not being an investment fit and we pass on them.

Investing in the State of Wisconsin

One of the best decisions that we made early on is to laser focus our investment efforts on the state of Wisconsin.

At face value, constraints would appear to limit opportunity. But, we have seen quite the opposite. It actually forces opportunities in a very attractive way.

On a fundamental level, one aspect of investor deal flow is about discovering startup opportunities that others do not see. Our focus on Wisconsin allows this to happen.

I will expound on this in a post at a different time, but sometimes the best startup opportunities are NOT the ones that are shouted from the rooftops.

Sometimes, those best startup opportunities have a core group of insider investors, and only let you in if you come inbound to them and express interest. They aren’t actively looking for you as an investor.

We have had our own experiences with this. On two occasions, with back to back investments - Cylerity and Gripp.

Cylerity

Two examples of Ryan Wheeler of Cylerity and Tracey Wiedmeyer of Gripp

I discovered Cylerity while attending a Founders’ Community event in downtown Milwaukee.

While at the event, by pure networking, I met a University of Wisconsin-Madison student, Aaryush Gupta.

Aaryush was about to graduate from UW-Madison with a double major in Computer Science and Data Science, and a minor in Business. Over drinks, he described the AI-enabled projects he was working on. He shared that he had been working with a company in the healthcare space that processes Medicare, Medicaid, and commercial health insurance claims; that the CEO was a repeat founder; and that they had recently graduated from CDL (Creative Destruction Lab) Risk Stream. He said they were finishing up their institutional fundraise.

I was immediately intrigued and I said, “Wait, what’s the name of that company?”

“Cylerity”

I had never heard of it. “And where are you located,” I asked.

“We are in Madison.”

I exchanged business cards with Aaryush and asked to be connected to Ryan Wheeler, Cylerity’s CEO. Ryan had had several previous companies before Cylerity, so he carried with him a network of VCs in his rolodex. So, he didn’t necessarily need to be out there hitting the pavement in his backyard - until we discovered him through Aaryush.

That moment eventually led to our investment.

Gripp

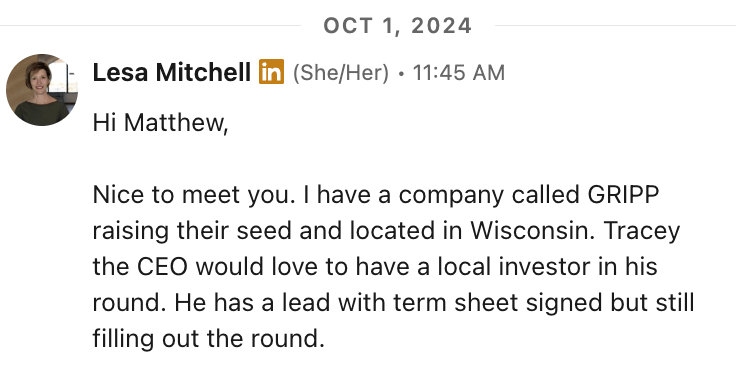

On October 1st, 2024, I connected on LinkedIn with Lesa Mitchell of High Alpha Innovation. She reached out on LinkedIn to me with the below message:

Tracey, like Ryan, had previous startups and exits before. He had a rolodex of investors in his ecosystem. Until an investor, Lesa, knew that Tundra Angels was focused on Wisconsin and made the connection. Until the discovery was made.

In both of these deals, none of the investors who I thought would be aware of them were aware of them. That may be a signal that you are finding some interesting opportunities.

I credit both of these great startups, in addition to many other positive downstream implications, to this singular decision to invest in Wisconsin.

Takeaways:

The downstream implication of tightening an investors deal flow funnel is that one also get deeper with their co-investor relationships (Oh and by the way, bring become more valuable to them as well as a source of solid opportunities as well)

It doesn’t have to be a geographic limitation, like that of Tundra Angels. There are many other ways to put constraints on opportunity.

Being Seen Leading with Value

A third tactic that we have done is become visible. Become discoverable.

Spencer X Smith coined this term that I loved called "Return on Top of Mind Awareness”

It is the aspect that if someone continually thinks about you (i.e. sees you on social media, and knows what you do), it will be a matter of time until they think about you in the context of something that is relevant to you.

This happens all the time to us.

The best thing that a VC investment firm, or virtually any firm can do, is to be readily discoverable. But not just discoverable, be seen as an expert.

It doesn’t matter if someone is an expert if they never show their expertise.

Our hypothesis is that founders will be attracted to Tundra Angels not because we can write a check, but because we are a network of experts.

Some question that founders are asking themselves about different investors they are courting is:

Does their thinking and mindset make me a better founder?

Will they make connections for me along the way?

Can I trust them?

With all of the content that we put out across our social media and newsletter, it aims to hit at answering these three questions.

The net result of this is that when founders show up a first Zoom call, often they are pre-warmed up as if they already know Tundra Angels. They have seen a number of social posts, they have received a newsletter article or two. They know what Tundra Angels brings to the table. I know this because they tell me this. They express their appreciation for the content and brand within the first 30-60 seconds of the call.

That’s what happens when you are seen leading with value.

Closing Thoughts

I want to be clear that Tundra Angels is not me, it is very much a “We.” It is the 50+ and growing network of investors that connects us with deals, that performs due diligence, that makes strategic connections to founders, etc. It's truly a joy to be able to do this. I feel so blessed every day to be able to discover great startup opportunities alongside them, learn alongside them, and invest with them.

I also want to thank our co-investors' relationships both in Wisconsin and beyond. My hope is that our value creation also becomes your value creation. We are grateful to be part of your ecosystem and to be a trusted investor partner alongside you.

I can’t believe it's been five years.

But on the same token, it’s only been five years.

I’ll harken back to something that I wrote a few minutes ago - investing in the index of the best startups in Wisconsin, Maybe instead of investing in the index of the best startups in Wisconsin, our portfolio companies become the index.

Now in reality, of course, we won’t have a 100% hit rate on everything. But that’s worth striving for. And that’s certainly a way to invest and mean something.

Click here to access the rest of the newsletter articles.

Here are some of the recent ones!