If you’re new to this newsletter, click here to access the rest of my newsletter articles such as the “Why We Passed on this Startup” series, reflections on investing, and tactics on winning in the market. Now, onto today’s post!

Defensibility Deprived

In June 2023, Sam Altman, CEO of OpenAI, responded to an audience question in a puzzling way. Asked if a group of Indian engineers could build foundational models with $10 million, Sam Altman responded, “It’s totally hopeless to compete with us on training foundation models, and you shouldn’t even try.” Video is embedded below.

Wait a second. The Sam Altman, who has invested in companies such as AirBnB, Uber, Reddit, and Asana, among many others, surely understands defensibility.

But… based on this clip, he saw OpenAI as impenetrable?

Well, the truth as he had that view with his company, so can we.

Defensibility is Unnatural…

I believe one reason is because thinking about defensibility is unnatural. It’s unnatural for us because growing up as kids, we were builders and creators. We’d paint pictures, we’d use Playdough to build a house, we’d create a Lego city, etc.

But how many of us actively defended and put up hedges of protection on what we had built or created - from a dog, from a younger sibling, from the wind, etc?

Probably hardly any of us.

In startups, when I ask a founder about how they will defend against competitive threats, I can tell when a startup founder hasn’t thought much about it. They tend to give me a thin answer.

A common answer is that they have “the best product in the market.” That’s essentially the Sam Altman answer above - “We have the best product, and you shouldn’t even try.”

Welp. Last week proved that wrong, again. But it was always wrong. Answers like this above indicate to me that the founder has an basic level of understanding defensibility.

…But Not Just for Founders

But you may be surprised to know a secret… I’ve also talked to quite a few investors who lack a solid understanding of startup defensibility.

I remember one time I had called up an investor to ask about a particular startup their firm was looking to invest in. Many times, when I do calls like this, I ask about defensibility.

In this particular case, I had my own hypotheses of what the startup’s potential defensible moats were, but I wanted to ask the question to hear the investor’s perspective. The investor didn’t come back with much.

Then I talked to the startup founder, who at the first conversation, I had seen several potential defensible moats in their business. But, even this founder struggled to articulate how they were going to create defensibility.

I found it odd that I had these tangible ways that the startup could build defensibility, but neither the investor nor the founder could articulate it.

But, I believe this is because defensibility is unnatural, and importantly, we lack seeing why defensibility even matters in the first place.

Why Defensibility Matters

The intended outcome of any VC-backed startup is to get acquired, to create abundant business and societal value, and to realize a financial outcome for its stakeholders.

How does a startup increase its chances of an acquisition? Defensibility is one major answer. To frame defensibility, I’ll use the metaphor of a castle and a moat.

Bodiam Castle, Scotland

When an incumbent or other market actor meets a startup, the actor has two main options. Either, 1) Leave the startup alone and see what happens, which is the typical initial posture. Or, 2) Go into attack-mode and try to re-route the startup’s moat.

✅ The startup’s aim should be to become so defensible that a market actor would prefer to pick up the entire castle rather than re-route the moat. ✅

You want to make your startup so defensible that it triggers an acquisition rather than war. That is, become so defensible that the market actor would rather not spend the time and capital trying to re-route your moat, but prefer to just pick up the entire castle and acquire you. Time and capital are the limitations of most opportunities or endeavors.

So, defensibility isn’t just a cute thing that investors inquire about.

✅ Investors know that startups that have strong defensibility asymmetrically increase their odds of winning in the market. Thus, they increase their odds of an acquisition. ✅

That’s why I as an investor care about defensibility.

Framing Defensibility

For a long time, I have wanted to write an article or series on the categories of defensibility and how I interpret them, but this is not that article. I still have not landed the plane in my own mind enough to put it into words about how I frame up defensibility myself. So, I will refrain from penning a post about right now. Some day, that day will come.

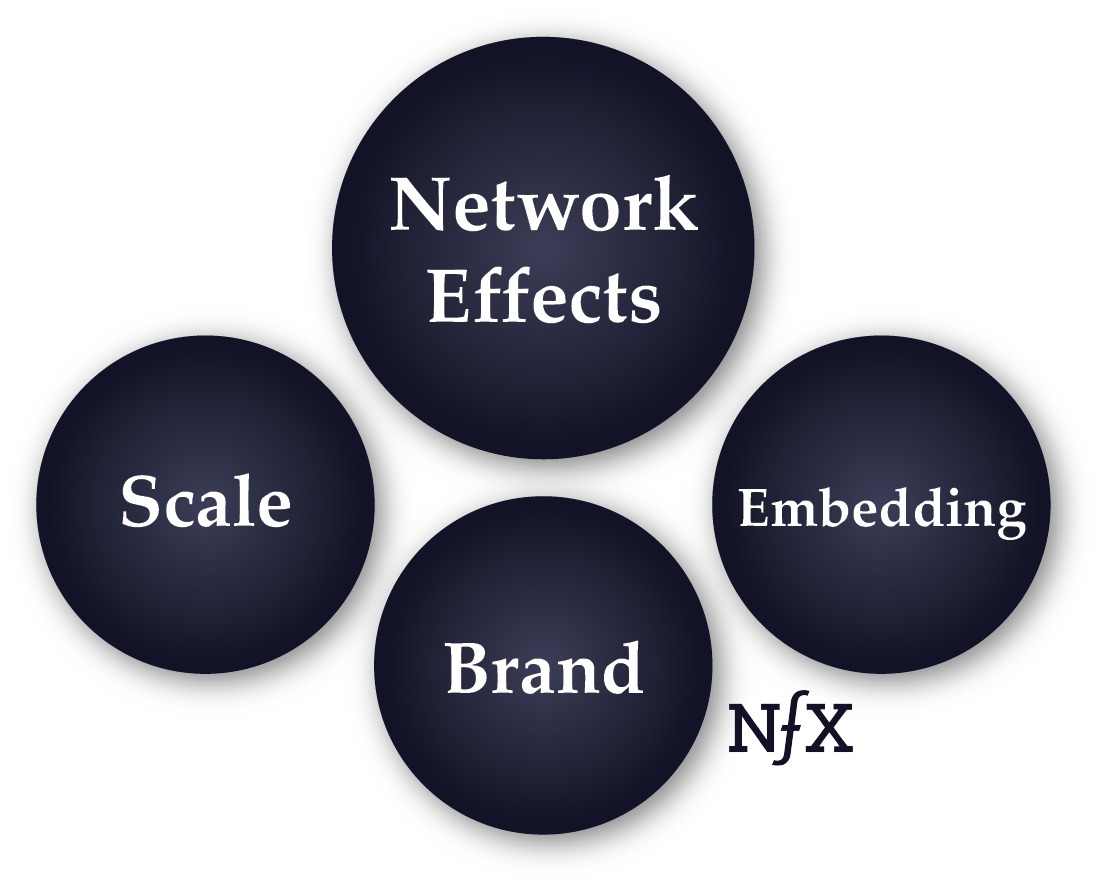

But in the meantime, let me share a framework that has helped me think about defensibility at a high level. It’s from James Currier of the VC firm, NFX.

Defensibility Examples

To give you some examples, here are three examples of defensibility from the Tundra Angels’ portfolio.

1) COnovate, with Co-Founder and CEO, Dr. Carol Hirschmugl. COnovate is a material science startup that has developed a new nano-composite that can replace graphite in batteries and lead to a 6x better charging time and a 2x better capacity. COnovate has a full suite of patents and trade secrets, both in their process and insights, that create a moat of defensibility.

2) Cylerity with Co-Founder and CEO, Ryan Wheeler. Cylerity helps healthcare providers get paid faster. Their tech platform ingests Medicare, Medicaid, and commercial health insurance claim data, verifies the accuracy of the claims, and underwrites against the claims to advance working capital to the healthcare provider cash within 36 hours.

Cylerity has several defensible moats. One in particular is their business model and go-to-market strategy. Instead of selling to the end user, the healthcare firm who is needing the working capital, Cylerity instead goes upstream to the payment clearinghouses that process the river of $4.5 trillion of healthcare payments and becomes an embedded partner to them. With a new value-add tool in their sales bag, the clearing house then go to their end customers, the healthcare provider, to get them opt-in to the Cylerity solution. That is how the right business model can create defensibility in a market.

With this move to sell into clearing houses, Cylerity avoids the draconian sales cycles in healthcare. This, by the way, creates another defensible moat - Cylerity’s rapid tempo of customer acquisition.

3) EVEN with Founder and CEO, Mag Rodriguez. EVEN is a direct to fan platform where artists can pre-release their music 14 days out, 30 days out, etc ahead of going onto streaming platforms. Followers can buy their music and get exclusive access to content that they only put out on EVEN. Funny enough, Mag posted on LinkedIn today a post that highlights several of their moats.

Network effects: One of EVEN’s defensible moats is network effects. As there are a finite number of artists, record labels, music distributors, all of which are rapidly moving onto EVEN because of how it gets artists paid nearly immediately without needing a global following.

Payouts take months but with EVEN it’s daily: This is a technological and a business model moat. The incumbents would have to re-write their entire business models if they were going to pay artists on their platform on a daily basis.

Access to fan data: This is a content and product moat. The incumbents would have to completely re-write their privacy policies and user agreements, as well as completely re-write their products to surface direct fan data to their artists.

With just these three examples, you can start to envision the defensibility at play that could cause an incumbent to just pick up the castle rather than re-route the moat.

Closing Thoughts

As Sam Altman displayed, no company, no matter how much talent or capital, is never impenetrable.

That’s why founders should be brutally honest of where you stand - is your startup a proverbial little hut in the countryside? Is it a tower without a moat, that needs to pay attention to defensibility? Or like Sam Altman, is what you think is your moat can be re-routed with a competitive maneuver? The goal should be for a startup to become a castles with deep and wide defensible moats.

✅ Defensibility matters because startups that have strong defensibility asymmetrically increase their odds of an acquisition.

Because you want your startup to become so defensible that a market actor would prefer to pick up the entire castle rather than re-route the moat. ✅

Click here to access the rest of the newsletter articles.

Here are some of the recent ones!

The Tale of Two Fundraising Founders

Why Creating Optionality in Fundraising is a Critical Ingredient