If you’re new to this newsletter, click here to access the rest of my newsletter articles such as the “Why We Passed on this Startup” series, reflections on investing, and tactics on winning in the market. Now, onto today’s post!

On the morning of Wednesday, December 4th, 2024 a would-be assassin shot and killed the CEO of UnitedHealthcare, Brian Thompson, outside of a New York City hotel. The horrific atrocity shook New York City, country, and the world.

I happened to catch pneumonia the day earlier, December 3rd. So, when the sickness came on with its fury and I could hardly get out of bed, I found myself with a lot more time. So, I was able to follow the story of this incident with a lot more detail than I normally would. As the manhunt progressed from its early days on Wednesday, Thursday, and then into the weekend, I couldn’t help but notice several inescapable themes in how the story was unfolding. Specifically, how that unfolding of the story carried themes that were also present in the world of venture capital.

Now, I’m in no way making light of this situation, the death of this man, the grief of his children, family and company. I’ve lost my father a number of years ago myself and so I am very sensitive to families who are grieving a loss of a father. In this article, I am choosing to focus on the manhunt itself and how those themes from the NYPD, the good guys, is similar to the world of venture capital and startups.

With that said, let’s go back to the beginning of when this assassination on early Wednesday morning, December 4th and see five ways how the manhunt for the CEO assassin acts like venture capital.

1) Initial Information Flows Rapidly

When the shooting initially happened around 6:50 a.m. on Wednesday, December 4th, the information flow initially came out at a rapid pace.

The news media reported on what they knew and the NYPD was grappling with what exactly happened. They knew much of the same information and were trying to discern the implications simultaneously.

As the first few hours unfolded, the news media reports to consumers on several key things - the initial surveillance videos, the discovery of important findings such as that a cell phone was left in a nearby alley, the suspect fled on foot, and then used an electric bike and then disappeared in Central Park.

In startups and venture capital, when the founder meets with the investor on a Zoom call, lots of information is exchanged quickly.

There is an initial burst of information gained. But even though the initial information comes out quickly, there is only a limited amount that can be gained in such a short amount of time.

There is a feeling of that the investor is just scratching the surface of the depth of the company. They are just seeing the startup at face value.

I like to say that, at this point, the startup appears one-dimensional. Only a limited amount of data points have been exchanged, which give the investor their initial impression of what is at hand. There is a feeling of that the investor is just scratching the surface of the depth of the company.

Even though through the manhunt, or in the initial founder/investor meeting, information initially flows quickly, there is way much more to be gleaned and those are found in additional data points over time.

2) Data Points Start to Hint at a Pattern

One of the earliest questions that the news media was trying to answer was whether or not this person was a professional killer.

The assassin’s highly targeted choice of the victim seemed to initially infer that perhaps this assassin was a professional paid to do the deadly act. More data points are required to put together the mosaic of the kind of person the suspect was.

When a founder and an investor meet for the first time over Zoom or in-person, there is no background nor experience with each other.

In those moments, the fundamental question that both the founder and investor are looking to answer is, “What is this person and company like?”

The investor might to seek to learn more data points on the founder and company by asking for a data room link, specific documents, or requesting another call with the founder.

✅ Investing doesn’t happen from singular data points. Venture investing requires the investor to stitch together a story on that company. ✅

As more data points come together, it starts to hint at a pattern of what that person and company could be like.

The data points help the founder and investor move from snapshots in time to a panorama video of the story.

3) The Information Bifurcates into Two Degrees of Insight

As Day 2 of the manhunt progressed, I observed that an inflection point happened.

It seemed that what consumers knew and what the NYPD knew bifurcated into two different degrees of insight about the situation.

In short, each one experienced a different velocity of inputs into the process…

….which created two different realities (perceived reality vs. true reality)…

…because one of the key drivers of leverage is information asymmetry.

The velocity of inputs into the process…

There was an inflection point where the news media suddenly had a drastic slowdown in the new information that they were releasing and reporting on. I observed that many of the news media outlets had possession of the same information and were simply slicing it many different ways. For a period of time, I stopped following the manhunt coverage as frequently because I wasn’t learning anything new about the story. In essence, the number of inputs the news media was receiving into their news process, was dramatically lower than it was when the incident initially was reported.

But, the information flow that the NYPD was receiving was accelerating - rapidly. At their press conferences, the NYPD was talking about how they were combing through hundreds of hours video surveillance footage, that they were getting hundreds of tips through anonymous phone calls, picking up all these clues across New York City, etc.

The velocity of inputs each one was receiving bifurcated into two different degrees of insight about the exact same incident.

…create two different realities…

The differing velocity of inputs created two different realities - a perceived reality of what we thought was happening and a true reality of what the NYPD knew.

Through the news media, the slow release of new bits of information gave the impression that the case was going very poorly. It seemed to infer that the NYPD was slow to react and was moving at a cripplingly slow pace to learn new information.

I specifically remember a moment two days after the shooting where the NYPD said in a press conference, “We have video of the potential suspect entering the bus terminal and not exiting, so we believe that the suspect might have left New York City.”

I remember thinking, “You are starting to suspect this TWO DAYS after this happened? How behind are you guys?!”

But I had to check myself.

It was not that the NYPD’s velocity of information input was slow.

It was that the information flow to the news media, and then to me was slow.

On Day 3, I also remember hearing an interview with the Mayor of New York City who told reporters, “The net is tightening. We are close to getting this guy.”

I was like, “How in the world is this possible? You just discovered that he left New York two days later after this happened, and now you say ‘the net is tightening’! It seems like there are still a lot of holes in your knowledge!”

✅ But, I had fallen into a mental trap. The mental trap was that the velocity of my information inputs defined what I viewed to be true and real and how I perceived the situation to be unfolding. ✅

Yet, there was a true reality that I nor the news media was privy to.

The NYPD was putting together the true reality of the story generated from endless data points coming at a high velocity that the news media was not privy to. These were data points such as the video surveillance across the city, the results of DNA testing at the crime scene, the places the suspect went, the results of the questioning of the two guys who stayed in the same room of the suspect at the hostel, and on and on. This collective of inputs that the NYPD was receiving defined the true reality of what was actually happening. The true reality that only NYPD experienced.

At one point, I recall a news anchor seeming quite bothered at how these two different realities in the story were emerging, commenting to a panelist what I believe most consumers had concluded at this point, “I think it’s safe to assume that the NYPD knows way more than they are letting onto.”

There is public knowledge - what the news media and consumers knew - that inferred how the case was going.

And then there was non-public knowledge - what the NYPD and other insiders knew - that defined the true reality of how the case was going.

…because information asymmetry is one of the key drivers of leverage in uncertainty.

Here is non-obvious part of this. The consumers/news media were way behind in the flow of information because that’s how the NYPD wanted it to be.

As the NYPD became very slow to release any new and substantive clues or evidence to the news media, they were actually very intentionally curtailing the flow of information.

✅ Because, in effect, the key driver of the NYPD’s leverage in the uncertainty of the manhunt was the information asymmetry. ✅

But for the NYPD, it’s not just information asymmetry that naturally occurs. Importantly, their information asymmetry is intentionally perpetuated and controlled.

If the NYPD could control the flow of information to the public knowledge, then they would have an advantage over the suspect. The suspect would be left guessing as to what and how much the NYPD knows and doesn’t know. In a manhunt, that would be one of the key advantages in catching the suspect.

Thus, it is an intentional act of “We do not want you to know what we know.”

If the NYPD and consumers were somehow able to operate with perfect or near-perfect information, knowing the exact same information at the near exact same time, then the suspect would know about the NYPD’s every move and thought and be able to counter-act it.

Similarly, in startups and venture capital, founder and the investor both have two degrees of insight.

The #1 asset that investors have is an extremely high amount of startup inputs. Startup founders are running one company. Investors could talk to 20 companies in one week and draw insights across all of them. This level of learning velocity allows investors to compare strategies and tactics of one company versus the strategies tactics with another. That’s an insight advantage.

Furthermore, startups do not have visibility to the number of startup deals that the investor is considering at that moment in time. This creates a perceived reality that the founder feels vs. a true reality that the investor sees.

When I was a founder, I gauged my perceived reality of my fundraising success by comparing my startup to other peer founders that they know are raising. The founder’s sample size though, is very small. For investors, the sample size is tremendously large.

The differing velocity of inputs affects the founder’s perceived reality of fundraising success versus the true reality of what the investor sees with the sample size her or she has access to.

This is not to say that investors make all the right decisions with this large sample size of data. This sample size can actually often times be relied on too heavily and stifle any creativity and outside the box thinking that is required to believe in a startup that will define the future.

There are degrees of insight informed by two different velocities of inputs.

✅ Lastly, there is tremendous information asymmetry at play between founders and investors. ✅

If I’m being honest as a former founder, the information asymmetry is what bothered me the most about fundraising.

The information asymmetry provides a driver of leverage in making a decision on a startup. And truth be told, investors want to keep it that way. There is a clear aspect of investors of “We don’t want you to know what we know.” But, ultimately there is no way for founder to know.

Unfortunately, information asymmetry can also act as a cloak that allows the investor to hide behind a “pass” decision without giving much intelligence as to the “why” behind the decision.

It is what leaves the founder guessing - “Did I confuse them,” “Did I not explain the solution correctly,” “I should I went into my demo right after the pitch concluded, etc.”

Yet, information asymmetry isn’t all about the founder’s disadvantage. I write in this article how founders can actually use the investor’s mindset and information asymmetry to their advantage. See article of “When Founders and Investors Unite.”

4) A Single Action that Confirms the Pattern

We earlier spoke about how the first burst of data points started to hint at the question, “What is this person like?” Namely, “Is this person a professional?”

Up until this point, NYPD was already inferring what this person was like based on the clues. The suspect seemed to not be a professional because he was quite thoughtless and casual with the evidence he was leaving behind.

But then, a single action confirmed this pattern when the NYPD released this picture of the suspect at a local hostel, smiling at the desk worker.

This single and novice act of revealing a facial identity so blatantly confirmed that this person was not a professional. In this manhunt, this move of pulling down the mask was the linchpin action that made sense of the other data points that the NYPD had collected.

In startups and venture capital, founder and investors are dropping data points of “who they really are” all the time.

✅ But often times there is a singular move on either side that is the fundamental action that explains all of the other experienced behavior. ✅

It could be a negative pattern of behavior that leads to a pass decision. You can read a host of examples from my “Why We Passed on This Startup” series.

But sometimes it’s a pattern of really great behavior that the founder displays. Then, at some point, the founder does something so bold and courageous that it is the singular move that underscores the quality and caliber of the pattern of the founder. I share a specific example from one of the Tundra Angels’ portfolio founders in this one minute clip below. 👇

5) Activating Externally-Sourced Intelligence

With the release of this photo, the NYPD intentionally activated the next phase of the manhunt - accelerating their inputs even further. They intentionally sent this key picture out to the news media, who plastered it everywhere across the internet world. They were adding another layer onto their intelligence.

Instead of previously only having internally-sourced intel (video surveillance, GPS location, cell phone signals, eyewitnesses), they added a layer of externally-sourced intel.

In effect, by sending out this picture they turned the entire world into a participant in the manhunt to help them locate and capture this suspect. Now, with people seeing this picture, it would activate a layer of intelligence of people who might recognize the suspect and call in to the tip line.

In the manhunt, this additional layer of externally-sourced intelligence proved to be the key decision in success. Obviously, as we know, it was this critical piece of intelligence that allowed a McDonald’s employee to recognize the suspect in a Pennsylvania McDonald’s five days after the shooting.

The equivalent to this startups and venture capital is when the investor activates his or her network to gain more intelligence on the startup and/or founder. This could be a phone call to someone who is strategic to the space of that startup. It could be a text message to another investor that the founder indicated that they had spoken to.

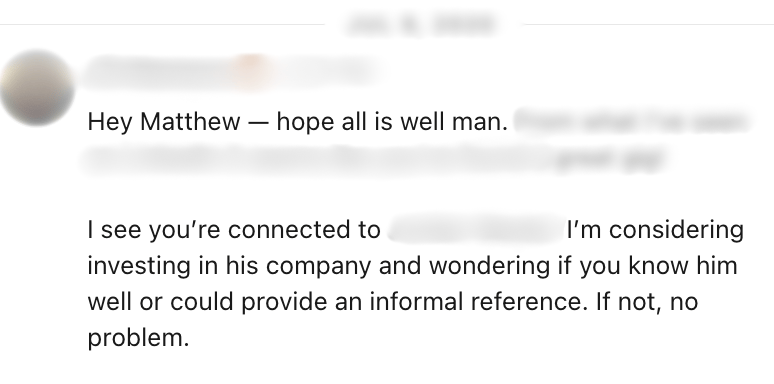

Externally-sourced intelligence for investors is indispensable to venture capital investing. In many ways, it falls under the information asymmetry category. Lots of non-public information gets exchanged that the founder is likely unaware of. For example, I once received this LinkedIn message from an out of state angel investor in my network, asking about a founder that I was connected to…

I did actually know the founder that he was speaking about - quite well actually. So, I exchanged bits of intelligence gave this angel investor data points to help him make an informed decision. This is just one example out of many types of externally-sourced intel. It’s bits of externally-sourced information like this that is critical to investors when making a decision.

Closing Thoughts

The information exchange between the founder and investor initially happens rapidly, which starts to mark data points to understand “What is this founder and company actually like?”

Then, two degrees of insight emerge based on the velocity of inputs that each one experiences - the founder is only running their company and the investor can see 20-40 startups in a given week. This leads to the founder believing a perceived reality of what the investor is thinking vs. the investor sees as a most holistic, true reality.

As more data points are collected, both the founder and investor put together a pattern on what the other is like. Sometimes this is confirmed by a singular move that confirms the pattern, either positively or negatively. Lastly, externally-sourced intelligence and information asymmetry is one of the main ways that investors triangulate making an informed decision.

Unlike a manhunt with the NYPD trying to catch this suspect and bring him to justice, founders and investors are actually way more on the same side of the table that may be perceived.

In a startup investment, the best aspects of the founder and the best aspects of the investor should come together in a united goal - to generate a strong financial return for everyone involved, and transform an industry for the benefit of society. That is something true and good that the city, country, and world can all rally around.

Click here to access the rest of the newsletter articles.

Here are some of the recent ones!