If you’re new to this newsletter, click here to access the rest of my newsletter articles such as the “Why We Passed on this Startup” series, reflections on investing, and tactics on winning in the market. Now, onto today’s post!

There was one time when, in the exact same week, I spoke to two different founders who made vastly different decisions about their fundraises.

The First Founder that Bowed Out

At one point, there was a founder, Zack, that I had been evaluating for a number of weeks. Zack was raising $2.0M, and had several angels committed and a strategic investor at the table. There was also a potential lead investor that I knew and I was aware was in deep conversations with Zack’s company.

My conversations with Zack were super positive up with no red flags. Although Zack was a first-time founder and this would have been their first official institutional round, I had confidence on his ability to flex the fundraising skill set and execute a successful fundraise.

My Plan A move was that this lead investor would commit, set the terms, and Tundra Angels would be able to slide into the round along with strategic investor and the existing angels. The signals seemed positive and this outcome seemed very plausible.

Thus, I had invited this founder to pitch to Tundra Angels and Zack had mutually confirmed. I was planning on it and the logistics were in place.

With every founder that pitches to Tundra Angels, I suggest a pitch coaching session so that I can help the founder tune the pitch to the investors and who I know will be in the room. So, we got on the first Zoom call to do the pitch coaching.

But then something changed.

Zack started the conversation saying that the lead investor they had been in conversation with had committed to their round was going to come with a larger check that anticipated, taking up the majority of the round. Additionally, the strategic investor had verbally committed to their round. Between this lead investor, the strategic investor, and the existing committed angels, the round had been filled up.

Zack said, “There is no longer a need to pitch Tundra Angels.”

I was super disappointed. I liked the founder a lot. It was a big let down.

Yet, everything was still in the verbal commitment stage, so I suggested still pitching to Tundra Angels and seeing what happened.

But, Zack was adamant, self-admitting, “I’ve been fundraising for so long, I am exhausted and want to be done.”

We conversed for a few more minutes and then ended the call.

How Introspection Jostles Reality

To take you into my mind for a minute, there had been times that a fundraise had closed or was already subscribed before I made contact with the founder. But I believe this was the first time that we were the consideration set but got bumped out. And our pitch meeting was only three weeks away!

The lead investor coming in was what I was hoping for, but I didn’t consider a scenario where Zack would completely bow out of the pitch and not give Tundra Angels an opportunity to invest at all.

When an investor gets bumped from a round, at least for me, it plunges investors into serious introspection. That’s how I spent the next hour. Most of the time, in that mental state, my mind plays games such as what didn’t I do or how could I have added value more for this situation to have not occur? I had built a great relationship with Zack and trust was there.

In my mind’s eye, I started to play out the success that this company could have without Tundra Angels on the cap table. At the same time, Zack was bowing out of an opportunity for capital with a term sheet in hand but only verbal commitments filling out the rest. That didn’t sit right.

A Phone Call with the Lead Investor

Ironically, just four hours later that day, I had a conversation with Karli, an investor at the VC firm who was leading the round. I brought up that they had offered Zack a term sheet.

To my surprise, the term sheet offer to Zack’s round had only happened the day before. It was so new that Karli wasn’t aware that one of the other investors in the firm had actually made the offer. So, I found myself delivering this news. Then, I also shared what had happened several hours earlier with Zack and I.

Karli: “What?!” “Why would he do that?”

Karli couldn’t believe it.

Karli: “Zack doesn’t have any of his capital committed! A term sheet is in place but the strategic investor has verbally committed but the money is far from being in the bank. Most of what Zack is speaking about is still only verbally committed.”

That jolted me from my introspection. Karli and I were totally aligned.

Me: “That’s what I was thinking too.”

Then Karli shared a nugget of insight from their investing experience.

✅ "You always want to have as many checkbooks at the table as possible.” ✅

After hanging up with Karli, I had a completely different perspective. I wasn’t the only one that Zack’s behavior didn’t sit well with.

Zack had shown his cards. Perhaps he wasn’t the kind of founder we wanted to invest in after all.

Rather than feeling like we missed an opportunity, Zack’s startup now felt like an opportunity that I was grateful to have missed.

The Second Founder that Leaned In

Exactly seven days earlier, I had encountered a very similar situation. Except, this founder took a different path. The founder’s name was Mag.

On my initial call with Mag, just seven days before the situation above, Mag and I chatted about what his company was doing. He was also raising $2.5M. I was very intrigued with what he was doing. At the end of the call, I said, “Hey man, I’d be super interested in having another conversation with you. When works?”

Mag said, “Just to let you know, we are already oversubscribed on the $2.5 million. I’m just going to be honest with you that I really don’t know if it will work out to let Tundra Angels in. But, let’s still have another conversation and go from here.”

✅ Both founders had fully subscribed or oversubscribed funding rounds. But one stopped their fundraise. The other one kept going. ✅

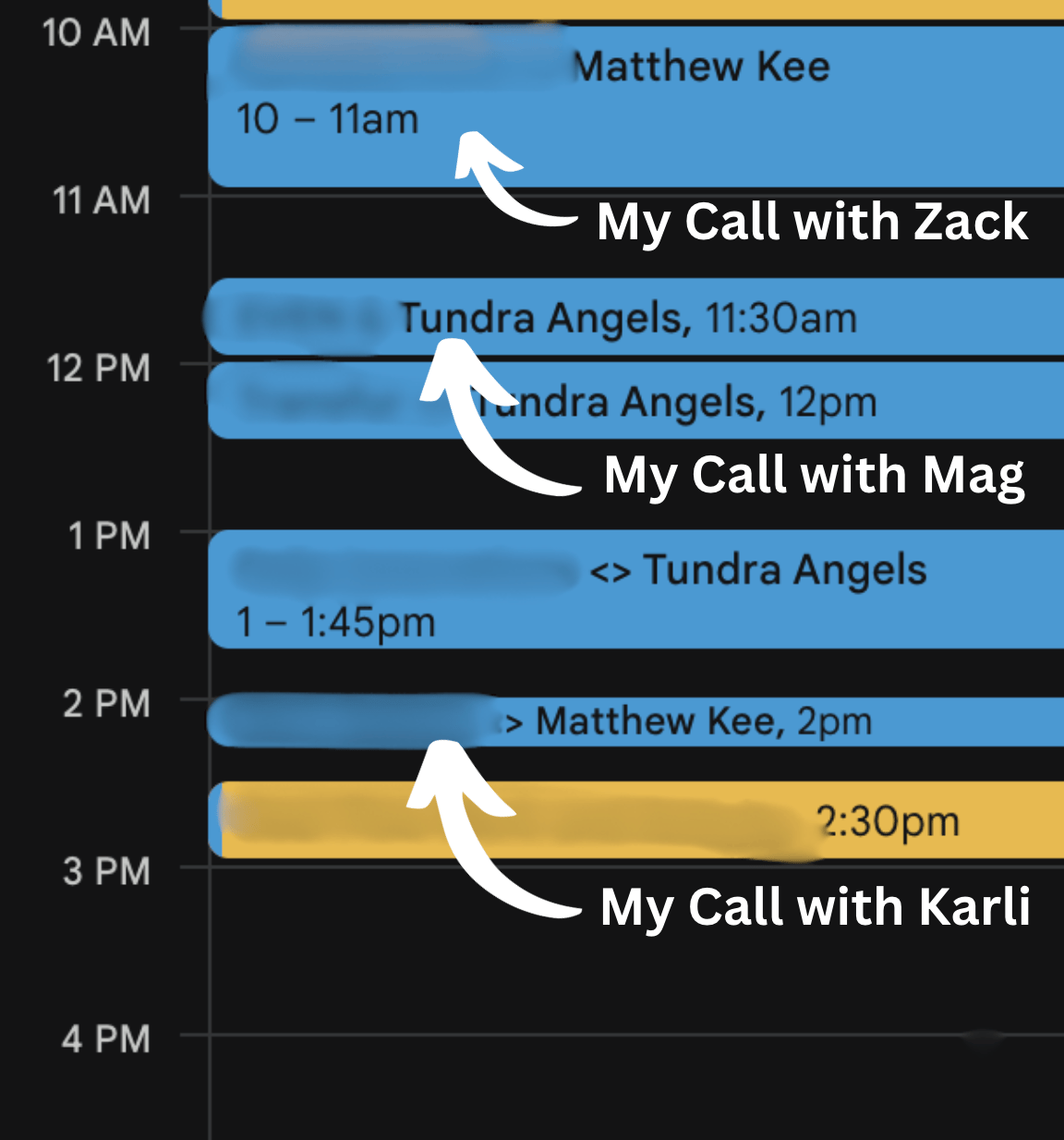

So, Mag and I had a second conversation - ironically on the exact same day that my above conversations with Zack and with Karli transpired. This is a screenshot from my calendar on that day.

It was on the call that day that Mag told me that he wanted to move forward in the Tundra Angels’ process and I shortly afterward invited him to pitch our group.

The irony couldn’t be more stark. On the exact same day, Zack bowed out of the opportunity and Mag leaned in to the opportunity.

As Mag leaned in, Tundra Angels leaned in too. Weeks later, Mag Rodriguez, and his company, EVEN, became Tundra Angels’ 19th portfolio company. For more detail here, see my article for Why Tundra Angels Invested in EVEN.

Mag Rodriguez of EVEN

Where the Finish Line Actually Lies

✅ There are founders that see a verbal commitment as the finish line with an investor. ✅

The founders that believe this don’t realize it, but they are limiting their optionality drastically. If one investor doesn’t pan out, or a number of them pull out, their entire fundraise is threatened.

✅ Then there are founders that see the finish line with an investor has not been reached until the money is in the bank. ✅

These founders believe what Karli astutely pointed out - "You always want to have as many checkbooks at the table as possible.”

It’s not a warm and fuzzy feeling with an investor that you felt over a Zoom call. It’s not a verbal commitment. It’s not even a term sheet. The finish line with an investor is when the cold, hard cash hits the startup’s bank account. The founders that execute like this create a lot of optionality in their fundraise.

To give you a sense, Tundra Angels just closed on a yet to be announced portfolio company. For the last $100,000 or so of the round, the founder and CEO probably had 15 investor leads, all of which verbally said they would or could strike a $100,000 check.

But you know what happened? Because the CEO gave themself optionality, they were able to close that last $100,000 with their first choice of the remaining 15 leads, a strategic investor that will be highly influential in the next leg of their journey.

But because of the optionality, if this first choice investor didn’t pan out and this strategic investor decided not to invest, closing the rest of the round wasn’t going to be an issue.

That’s the power of investor optionality, and seeing the finish line as the money in the bank.

Closing Thoughts

Fundamentally, a successful fundraise is a business development exercise under a tight timeframe. Founders want to have as many checkbooks at the table as possible, and don’t stop fundraising until the money is in the bank account.

Oh, and the strategic investor that had committed to Zack’s round? A long time later, I found out from an external source that they ended up pulling out of the round and didn’t invest. So much for a fully committed round.

But, that’s what happens when founders don’t keep their options open.

Click here to access the rest of the newsletter articles.

Here are some of the recent ones!