If you’re new to this newsletter, click here to access the rest of my newsletter articles such as the “Why We Passed on this Startup” series, reflections on investing, and tactics on winning in the market. Now, onto today’s post!

Today, I’m kicking off a series of “Why Tundra Angels invested in _______,” for the most recent investment, EVEN, and the ones that Tundra Angels make in the future. This post is about our 19th investment, EVEN.

This is the story how Tundra Angels invested in EVEN.

✅ An investor’s poor assumptions is the #1 factor that can kill an startup opportunity before it’s even begun. ✅

Unfortunately, many investors leave assumptions about particular startups completely unchecked, causing them to mis-categorize startup opportunities.

Venture capital investors need to be keenly aware of those assumptions are for each startup, and be curious enough to prove or disprove those assumptions.

With EVEN, I held two pre-existing assumptions that nearly tricked me into missing Tundra Angels’ 19th investment.

The Assumptions that I Brought In

Here are the two assumptions that I brought into my first conversation with Founder and CEO of EVEN, Mag Rodriguez.

Assumption 1

Years ago, I had heard about EVEN after their pre-seed round was announced in April 2023 in this article. Do you know what I thought?

“The world doesn’t need another Spotify.”

I thought EVEN was in the same category as Spotify, Apple Music, etc. I carried this assumption for two years because, before my reach out to Mag, I was never confronted with a context to learn about EVEN.

Assumption 2

In my typical deal flow, music technology is not one of the major categories that I typically see. Yet, there was one music tech play that pre-dated Tundra Angels that I was familiar with - it was a platform called LUM that was based in Madison, Wisconsin. I had been connected on LinkedIn to the Founder and CEO for a number of years and I didn’t fully understand all of the intricacies of the platform. But after raising several million in VC and bringing on Ne-Yo as their brand ambassador, LUM shut its doors, covered in this article. It was totally unexpected to me and to those following their journey.

LUM, once a darling of Wisconsin startup scene, now ceased to exist - but I didn’t know why. That was an open and unresolved question to me.

My main question of, “Why did LUM fail?” nagged on me since LUM shut it’s doors and I wasn’t in the music space enough to know the answer.

Encountering EVEN

Through one of our investor deal flow channels, I saw that EVEN was raising funds.

Keep in mind, from the two assumptions above, I saw EVEN and seeing the company name, I consciously ran through the two assumptions that I had - “This is probably just another Spotify competitor,” and also, “The music tech space is so hard, just look and how LUM wasn’t successful.”

But despite those assumptions, I still decided to reach out, just in case my assumptions were incorrect. Better to give ourselves the opportunity to invest rather than to decline the opportunity without true knowledge of what it entails.

I’m so glad I did. I reached via a cold email to the Founder and CEO, Mag Rodriguez.

Mag responded.

Primary Reasons Why Tundra Angels Invested in EVEN

Non-Obvious Insight: Artists Actually Don’t Need a Global Following to Make a Livable Wage

This is EVEN’s contrarian take in the current music industry - streaming platforms are predicated on needing a high volume of fans for artists to make a livable wage. EVEN makes it possible for artists to get paid what they are worth without needing a global following.

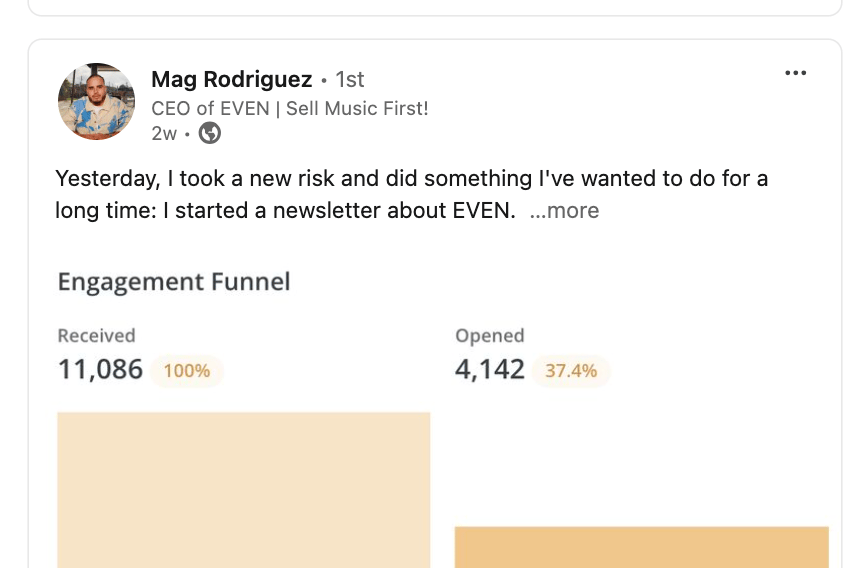

This is best summed up one of Mag’s LinkedIn posts from late August 2024:

“This week, an artist with 200,000 monthly listeners (about $700/month) on Spotify earned $28,000 on EVEN in just 24 hours—all thanks to the support of 1,000 dedicated fans.

The average fan paid $28, and the release was streamed 18,000 times on EVEN. This means the artist earned an impressive $1.55 per stream.”

Mag went on surface the contrarian take: ”To earn $28,000 on streaming platforms, this artist would have needed over 8 million streams—requiring more than 1 million fans!”

EVEN sets up a drastic choice for artists -

Either only put your music on streaming platforms build a global following of hundreds of thousands to make money,

Or, add EVEN into the mix and get 1,000 people to buy your album on EVEN.

Which one is more accessible? We really liked EVEN because the value proposition is practically a no-brainer for artists as well as their distributors.

Competition: EVEN Works in Harmony with Spotify, Apple Music, and other Streaming Platforms

In my first conversation with Mag, I realized something vital that totally disproved my initial assumption of “This is probably just another Spotify competitor.” From a competition perspective - EVEN does not replace Spotify, Apple Music, etc. Rather, EVEN positions itself as a platform for artists to build community and pre-release their music 14 days out, 30 days out, etc ahead of going onto streaming platforms. Followers can buy their music and get exclusive access to content that they only put out on EVEN.

This revelation brought a lot of clarity for us to the competition - “Oh wow, EVEN is not competitive with and doesn’t take anything away from Spotify or Apple Music. It actually adds value to them.” Mag cited several examples of how an artists releasing on EVEN actually boosts streams once it goes live on Spotify or Apple Music.

As any market is cutthroat, especially the music industry, the fact that a startup we could invest in could be seen as a partner to the incumbents, not a threat, made us think much more favorably about the EVEN opportunity.

As Mag says, “It’s not EVEN or streaming, it’s EVEN and streaming.”

When a startup can enter and market and be a partner, not a threat, to the incumbents, that’s a incredible wedge.

Team: A Leadership Team that Came From the Industry, not Infiltrated It

I brought up one of my pre-existing assumptions. “Have you heard of LUM? Why did they fail?”

Mag, simply put, said, “The team didn’t come from the music industry, so the industry didn’t fully embrace them.”

Whoa.

Mag went on to talk about how he had been an artist manager for several big name music artists that had over 1 billion streams in aggregate. He later worked for gener8tor, a venture capital firm and startup accelerator network, and built out gener8tor’s music technology platform.

Mag a music industry insider, turned venture capitalist, turned startup founder.

Mag’s uniqueness was solidified to us during the due diligence process. We investigated the backgrounds and premise of other direct-to-fan platforms in the music industry. It broke out into two categories - other music tech founders were either music industry insiders and didn’t know much about tech startups and VC, or came from startups and VC and didn’t know anything about the music industry. Mag had this super power where he possesses expertise in both worlds.

Business Model Innovation: Enter the Paywall

One of the critical pieces of the EVEN model is that fans purchase the art from the artists before it goes onto streaming platforms.

We asked Mag, “How did you come up with this thesis of the paywall? It seems non-obvious.” Instead of accepting half-compliment, Mag responded with a surprising comeback, “Actually, I’d argue that the paywall is very obvious.”

He then went on to detail that the common threads in the markets of “You want it now, you have to pay for it,” and that there is always a premium associated with exclusivity and convenience. Mag sums up the effectiveness of the paywall in this video clip.

Defensibility: Network Effects at Play

As we thought about the future defensibility mechanisms, EVEN already had network effects in play and there was vast potential for stronger network effects. As one artist and one fan joined EVEN, it adds overall value to every other person on the platform.

Network effects is one of the best forms of startup defensibility.

Closing Thoughts

It’s impossible to cover the secondary and tertiary reasons that Tundra Angels invested in EVEN, and obviously some reasons are confidential and cannot be shared.

In this deal, we were super grateful to invest alongside Chris Abele and Steve Mech of CSA Partners, LLC, Jennifer Abele and Raquel Filmanowicz of VC 414; Troy Vosseller and Joe Kirgues of gener8tor, among many others.

A cool and unexpected form of validation was that I received lots of connection requests from music industry founders, a number of which sent messages such as….

This, out of many other reasons listed above, is why Tundra Angels is excited to get even with EVEN.

Click here to access the rest of the newsletter articles.

Here are some of the recent ones!