If you’re new to this newsletter, click here to access the rest of my newsletter articles such as the “Why We Passed on this Startup” series, reflections on investing, and tactics on winning in the market. Now, onto today’s post!

In an ideal world, bridge rounds wouldn’t exist.

True, execution sometimes doesn’t go as planned. Totally get that.

After investing for over four years and in 19 companies, I fear that many bridge rounds are the symptom to a deeper root of the problem that startups do not know how to adequately plan their fundraise.

Let me explain what I mean.

Insights on Fundraising from Football

Fundraising is very similar to moving down the football field.

In football, a first down is ten yards. If the Green Bay Packers offense gets a first down, they receive another first down and a fresh set of four downs to get another 10 yards to continue to move down the field in sequence to score a touchdown.

Parlayed to startups and venture capital, let’s assume that each investor round (Pre-Seed, Seed, Series A, Series B, etc.) represents the next first down, one another another. That’s how it functions in practice. When the Green Bay Packers get a first down, or a startup closes a fundraising round, they get a limited set of time to make it to the next first down or funding round. Or else, they have to punt.

Knowing where the first down is gives clarity to execution. If the Packers are facing a 3rd and 22, then typically won’t run the ball and choose to pass. Similarly, if they are facing a 3rd and 3, they are more likely to move the ball on the ground. They adjust their play calling to the scenario at hand - the distance to get the first down.

But in a hypothetical scenario, what would happen if the Packers didn’t know where the next first down is? In that scenario, they would have no idea how to do their play calling.

Clarity of the distance to the next first down makes all the difference in a football team’s execution.

But, when it comes to startups… I’ve seen that most startups plan their fundraises having no clue where the next first down is, that is, what the investors in the next round expect.

This is the Achilles’ Heel of most fundraises, and is a concept that I call “The Capital Chasm.”

✅ The Capital Chasm = the mismatch between:

The milestones that the founders’ are executing towards

VERSUS,

The milestones that the investors in the next round expect. ✅

At the bottom of the Capital Chasm is a vast startup graveyard, littered with tombstones of companies that fell into the chasm due to not making it to the next round of funding. That’s why a bridge round is called a bridge round. The startup needs more time and capital to bridge to the next stage of funding.

Yet, bridge rounds tend to be difficult entry points for new investors, and they only make sense for existing investors if the insiders like the traction story change since the initial investment.

That’s why that knowing what the next first down is, what the next round of investors expect, is mission critical when planning your fundraise. Here is what to do about it.

Plan Fundraising Backwards

Startups execute forwards. But they must plan their fundraises backwards.

They must ask,

✅ What value-inflection point is the next round investors requiring before they invest? ✅

Answers to this question give clarity to the question of, in football terms, where the next first down is.

Design Fundraises to Value Inflection Points

✅ Investors invest along “value inflection points.” ✅

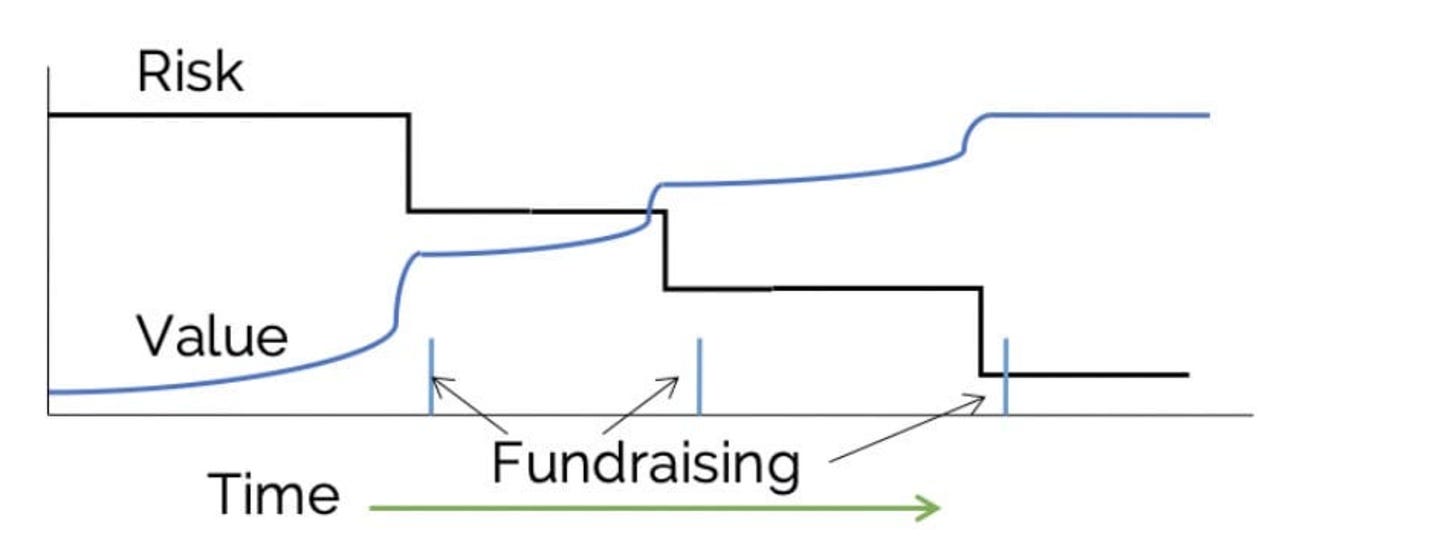

An value inflection point is a threshold moment that represents a step function decrease in business risk, which is accompanied by a step function increase in value.

One of our portfolio founders recently articulated this perfectly. Faraz Choudhury of Immuto Scientific recently spoke on a startup panel at a conference that I attended. The moderator asked Faraz a question about a special moment in his startup journey.

Faraz recounted a story in the life of the Immuto Scientific when a Big Pharma company had approached Immuto asking them to solve a problem with a particular cancer protein. The company had spend millions of dollars and untold amounts of time trying to figure this one problem out. Immuto Scientific was able to solve the problem and get the clarity this Big Pharma company was looking for. In his answer on the panel, Faraz specifically pointed to the moment in the lab when the team made this “a ha” moment discovery and realization. That’s a value-inflection point. “We can do what a Big Pharma company cannot do.” Now, that is a story that can sell to investors.

Similarly, when founders hear investors say, “We don’t invest in pre-revenue companies.” That’s because for many investors, the moment when a startup starts to generate revenue is a value-inflection point that VCs broadly understand. The value and risk are totally different being pre-revenue vs. revenue-generating.

✅ Value-inflection points are the moments where investors are most likely to invest in the company. ✅

Below is a graph that indicates this. With value-inflection points, there is a step-function increase in value of the business (the blue line), which means there is a step-function decrease in risk of the business (the black line).

Big thanks to my former Indiana University professor and startup founder, Matt Rubin, who created this graphic and shared it with me in my business school classes.

I will repeat again - value inflection points are the moments where investors are most likely to invest in the company.

A Textbook Example from a Portfolio Company

At one point, I got a phone call out of the blue from a CEO of one of the Tundra Angels’ portfolio companies. The CEO shared that they had just acquired a customer contract from the biggest brand name in their market. Incredible news!

Before this phone call, the company existed on one tier of risk. After I ended the call, in my mind, the company had moved a step function change in the risk of the company and the way that I knew investors would perceive the company’s future value.

On the call, the CEO also got my feedback on a potential fundraise. The CEO was leaning towards activating a fundraise around this value-inflection point, although that meant that they would have been fundraising sooner than they expected. But, we both chatted about the momentum that this customer contract would give to the fundraise and so I gave the CEO my vote of confidence. Sure enough, when the company went out to fundraise with this new traction story, with the value-inflection point, investors responded super well. They were able to raise a lot of money from existing investors as well as bring in a number of new VCs onto the cap table.

✅ Fundraises should be planned around value-inflection points because it just makes fundraising way easier. ✅

How to Plan Fundraises Around Value-Inflection Points

Startups should seek to understand,

✅ What value-inflection point is the next round investors requiring before they invest? ✅

Importantly, value-inflection points are contextual to the startup and the investor. So, the investors that you ask should be within the context of investors in your space and market.

The only perspective that matters is investors that could feasibly invest in you - otherwise, you’ll chasing the wrong first down. If you have a B2B SaaS startup that sells to insurance companies, it is useless to know what IoT hardware investors see as a value inflection point.

Tactical Next Steps

If you are planning your fundraise, first make a list of investors that would invest in the next round from where you are currently.

Secondly, ask yourself - Can this investor actually feasibly invest in this startup?

If yes, then put them on a list. Investors should be able to give you this feedback via email. You shouldn’t need to have a Zoom or phone chat with an investor to know this.

Lastly, I’d recommend sending an email to 10-20 investors in the next round of capital, using this message below (feel free to copy and paste and use it).

Hello,

I wanted to send you a quick note asking for your feedback on fundraising milestones.

I’m looking to plan my initial fundraise for my __[pre-seed, Seed, etc.]_ round. For context, here is a brief summary of our company….

Then, lay out in a brief paragraph:

Who you sell to

(Our customer is large insurance companies in the property and casualty space…)

The problem you solve

(…and we solve the problem of the amount of time it takes to do loan underwriting…)

The solution you deliver

(…so our software layers onto their existing infrastructure and brings in data to ¼ the time it takes to gather this data.)

How you make money

(We charge an enterprise SaaS fee which scales based on number of users.)

The revenue you generate per customer

(Our starting price is $20,000 for one company license which scales to $80,000)

Our traction at this point is __[traction]_.

For my type of company in this market, what would be the value-inflection point that would be a signal to you of, “OK, now we’ll take a serious look at this company”?

Thank you!

Importantly, value-inflection points are contextual to the startup and the investor, so make sure you ask investors who could feasibly invest in you.

The bonus is that, with this reach out, you demonstrate to the investors that you’re thinking thoughtfully about the next fundraise! Always nice to score founder credibility points. (You can thank me later 😀)

The good news is, once you give investors the context and message above in your reach out, they should be able to give a quite clear sense of what they see as their first down.

After 10-20 data points from investors in the next round, you’ll have a ton more confidence in planning your fundraise with the knowledge of what the next first down is.

Maybe the implication is, after calculations and what you can achieve with time and money, you need to raise double the amount of money that you are planning to get to the next value inflection point.

Maybe the implication of this is, after calculations and what you can achieve with time and money, you don’t need to accomplish as much as you think you do and can raise a smaller round!

Closing Thoughts

✅ The Capital Chasm = the mismatch between:

The milestones that the founders’ are executing towards

VERSUS,

The milestones that the investors in the next round expect. ✅

Founders address the Capital Chasm by planning their fundraise backwards, which informations their execution forwards.

The way that this is done is by learning what next round investors see as the typical value-inflection point before they invest.

Ultimately, the insight of value inflection points, you will plan your forward execution with an intelligently designed target investment amount that will enable you to accomplish the right value inflection point that the next round investor expects.

Shout out: Kudos to Greg Keenan and Joshua Carson of WARF Ventures for the inspiration this past week around this topic. Some of this has been rumbling around in my head for a long time and I’d be remiss if I didn’t mention that our recent chats gave me the motivation this past week to write about this.

Click here to access the rest of the newsletter articles.

Here are some of the recent ones!