When I was a startup founder, I found fundraising to be excruciatingly difficult. I observed statistics such as 1-2% of companies acquire venture funding. (Source)

In my moments of discouragement, I found myself asking, “Why is raising venture capital so hard?”

“With all of the startups out there, why do so few receive VC-funding?”

Maybe you ask yourself the same thing. “Why is fundraising so hard?” Can you relate?

Now that I have moved from the startup founder side and have been on the investor side for over three years, I will share my observation and answer.

You first need to understand the type of company that VCs are are looking to fund.

Venture Capitalists Don’t Play for Third Place

✅ Venture Capitalists invest in companies that they believe will earn and maintain number one market share in the category.

If they have to settle for second place, that’s a small consolation prize. Yet, investing in the second place company is only a stark reminder to themselves and to their investors that they didn’t invest in the number one company and missed out on the lions’ share of the returns in the market.

Venture capitalists don’t play for third place. ✅

Why Doesn’t Third Place Matter?

In the high growth technology space, the distribution of market share and customer adoption tends to cluster around the #1 and #2 companies in the market. It follows that there tends to be a very long tail of also-rans that no one really pays attention to.

Furthermore, there is a profound order of magnitude difference between the market share of the first, second, third, and fourth companies.

But this is not just my observation in practice. This is also backed up by data.

Category Kings Earn 76% of Their Markets

In the book Play Bigger: How Pirate, Dreamers, and Innovators Create and Dominate Markets, the authors speak about the companies that win markets as “Category Kings.” The authors write that,

“Category kings, the data show, usually eat up 70 to 80 percent of the category’s profits and market value. Our data science analysis of U.S. venture capital-backed start-ups founded from 2000 to 2015 shows that category kings earned 76 percent of the market capitalization of their entire market categories.”

With 76% on average going to the category king, the 2nd place player maybe occupies 10-20%, and the 3rd and 4th place players are sub-10%, most likely sub-5% market share.

Let me color this with some data. It’s easiest to describe this with globally known B2C technology companies that we are all familiar with so that we have a shared context.

Example of Food Delivery Companies

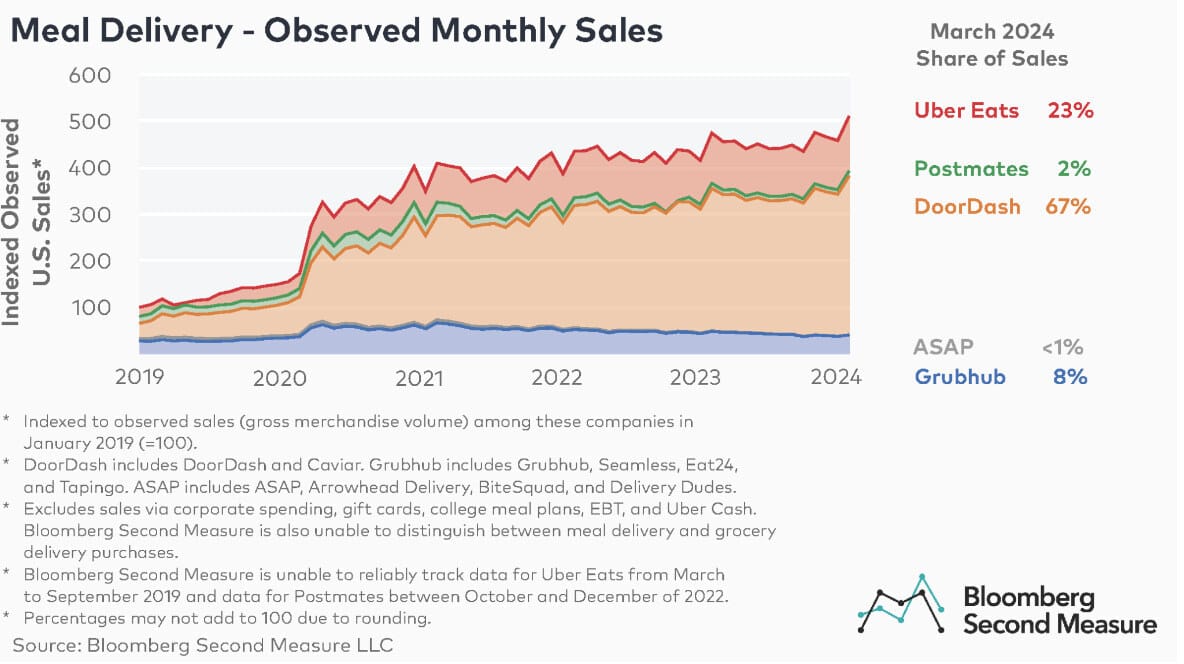

Food delivery is a staple of the world’s economy and consumer behavior. We often times hear UberEats, GrubHub, and DoorDash mashed into the same sentence.

But looking at their respective U.S. market share, they should hardly be mentioned in the same sentence, let alone the same podium!

Notice the order of magnitude difference between each of the companies below.

DoorDash - 67% U.S. share of sales

UberEats - 23% U.S. share of sales

GrubHub - 8% U.S. share of sales

Postmates - 2% U.S. share of sales

ASAP - <1% U.S. share of sales

Two Observations:

✅ Each company has a disproportionately higher market share that the one after it. ✅

The top two companies, DoorDash and UberEats, have a combined market share of 90%!!

As an interesting FYI, ASAP actually just filed for Chapter 7 bankruptcy.

For investors, it’s not worth investing in a company that will be 3rd place or beyond.

Furthermore, in certain markets, third place is literally non-existent.

There are two dominant companies in the ride-sharing market - Uber and Lyft

Uber’s 2023 Revenue - A staggering $37.3 Billion

Lyft’s 2023 Revenue - A “cute” $4.4 Billion

It should also be noted that in addition to its United States presence, Uber operates in 72 countries. Lyft, on the other hand, only operates in the United States and Canada.

Consider this for a moment - there are two major players in the ride-share market.

The distance between Uber and Lyft is literally 9X revenue and 70 countries.

Dominance like this is hard to crystalize in reality. But I’ll try.

A Comparable Example in College Football

My late father attended college at UW-Madison and was big into Wisconsin Badger football. Back in September 2010, I went with him to a game where the Badgers played Austin Peay. If anyone knows of that game, the Badgers scored a modern-era record number of points. Here was the headline and the statistics of the game:

A quote from the article, “The Austin Peay defense gave up 618 total yards of offense to Wisconsin. 346 of those yards came as Wisconsin pounded it out against the Governors on the ground.”

It was an incredible spectacle to be a part of. Such a great day to be a Wisconsin Badgers fan.

It’s not simply that the Badgers won this game, or a number 1 company wins its market.

✅ It’s that the degree of dominance is so blatant and disproportionate that it’s almost as if the first and second place players shouldn’t even be competing.

That’s the difference between investing in the Category King vs. anyone else. ✅

Implications

Back to the question that I was asking earlier, “Why is raising venture capital so hard?”

✅ One main reason is that VCs understand that the category king wins disproportionately more (76% in the above study) than the 2nd place winner.

If VCs do not believe that your startup will be number one or number two in your market, they will not invest.

Venture capitalists don’t play for third place. ✅

Of course, there are exceptions and many, many examples of VCs funding “me too” companies. I cannot speak for other investors but I do not believe that funding “me too” companies is a long-term successful investment strategy, especially based on the data above.

As it relates to your startup and vision:

Realize the game that you are in - the game that VC investors are playing

If you are feeling like your startup is in the “me too” category, get crystal clear on why you are doing what you are doing, and set a new course if necessary.

Play to win first place. In startups, there is no such thing as “good enough.” Startups are quite binary - you either play and execute to win first or you go home empty handed.

VCs are not going to relax their standards as they have LPs and investors to generate returns for.

It’s the founders’ job to set their sights high and illuminate to investors what the market ultimately needs. A startup’s goal is to be mostly right on the fundamental question of what the market actually needs.