👇 The Big “A Ha” 👇

The startups that win possess an asymmetric amount of leverage over their market(s).

Leverage comes from capitalizing on an inflection point.

Yet, these are far from random. Inflection points can and should be planned for. Here is how to do it.

Context: How Startup Growth Actually Happens

Most people tend to think linearly. Start with A, go to B, then to C, and eventually down the alphabet.

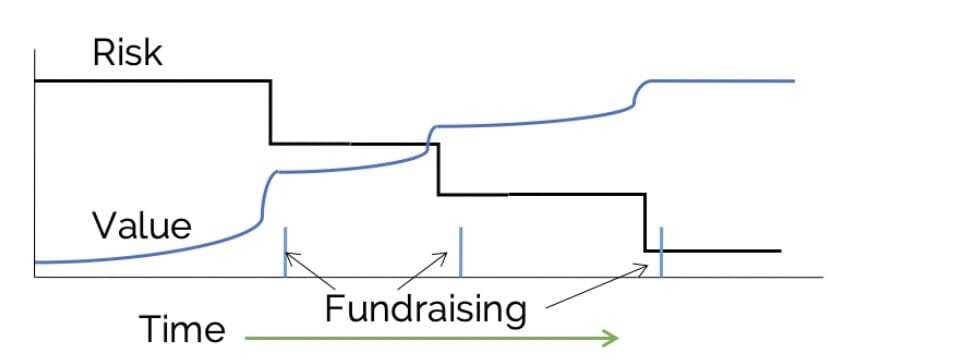

But startups that win have a different trajectory. They have a step-function change that leads to exponential growth. Take this graph below:

My Indiana University professor and startup founder, Matt Rubin, created this graphic and shared it with me. Matt was on my startup’s advisory board for about two years of my FinTech startup journey. I am in many ways a product of his insights from those formative years.

Yet, coupled with my current investor experience, I draw additional insights from this graph.

✅ I want to highlight two observations from this graph:

Startup growth, and by extension, value, does NOT increase linearly.

More specifically, startup growth is a function of “unlocks” or “breakout moments” along the journey that lead step-function increase of value.

I term these “unlocks” or “breakout moments” as a startups’ “inflection point.” ✅

You can further observe that inflection points tend to be, but not always, correlated with a fundraise.

But, when I saw this graph for the first time eight years ago, I asked myself this question:

👉 What is happening at those inflection points? 👈

👉 Specifically, what did the startup do for that to happen? Can it be replicated? 👈

👉 Lastly, is it random, or can inflection points be intentionally designed into execution? 👈

After speaking to about 120 startups on a yearly basis for three years and investing in 16 companies, I have observed countless patterns. I will share what is happening there, that yes it can be replicated, and yes it can be intentionally designed.

Inflection Points in Entertainment

If you apply this inflection point and step function change mindset to other trends in industries, you will see that it plays out. Let’s teleport from startups for a minute and observe this in a completely different industry.

I am a musician myself and I play guitar, piano, and sing. In high school, I had a garage band. We hardly moved outside of the garage except for one gig that we played. I still joke with people that I’m “still waiting for the world tour to start, 15 years later.”

Because of my aspirations to “make it big in music” at a young age, I had always been fascinated by artists and musicians and their rise from pure obscurity to selling out stadiums with tens of thousands of people singing their anthemic melodies or being watched in movies by millions of people.

Yet, most artists never hit it at all and spend their lives in anonymity.

But for artists that achieved colossal success, if you look close enough, what you see is one or a series of breakout moments over the span of a career. In the entertainment industry, this is referred to as “the big break.”

Let’s take a look at the actor Harrison Ford in this article, although many other examples could be used. Harrison Ford is one of Hollywood’s best known actors. Yet, it wasn’t until he had lived there for nearly 15 years that he had his breakout moment, or his major inflection point. Ford worked in various small films, plugging away as the years went on. What kept him going was the fact that he was a carpenter and that afforded his livelihood way beyond the typical time frames of actors who went to Hollywood to make it big. Ford met George Lucas after Ford auditioned for and was cast in the movie, American Graffiti. The movie saw some limited success - Ford’s first inflection point. But in a unique series of circumstances, several years later, Ford, a carpenter, found himself building a door in the same building where George Lucas was holding the casting call for Star Wars. Lucas at first used Ford as a convenient person to feed lines to the actors, but in the end, Ford beat out some great actors to secure the role of Han Solo. The true inflection point that led to a step function change in Ford’s career.

Inflection Points in Startups

✅ In startups, an inflection point, similar to the Harrison Ford example, is when the market moves from when a small group of people believe in it to a mass market amount of people believe in it. Or, put another way, a secret shared by a small few becomes mass market consensus. In an inflection point, that shift happens VERY quickly. ✅

Unlike in artistry where breakout moments tend to be more random and circumstantial, in startups, inflection points are just as real but cannot be random. They need to be planned for.

✅ Specifically, I have observed FIVE types of inflection points in startups:

Market inflection point

Customer inflection point

Consensus inflection point

Product inflection points

Technology inflection point ✅

Each of these possess potential ways to intentionally design a “breakout moment” for a startup.

✅ Ultimately, inflection points create an asymmetric amount of leverage in the market compared to others. ✅

In practice, this means that potential customers go from being super cold leads to hitting you up in droves. Or, investors go from being completely disinterested to emailing you asking, “When can we meet?”

Inflection points make execution way easier for startups. It’s about working smarter, not harder.

I will spend the next several weeks unpacking how to understand and design each inflection point in your startup. I’m really excited for this series and to share specific insights and anecdotes along the way.

Inflection points make execution way easier for startups. It’s about working smarter, not harder.

I will spend the next several weeks unpacking how to understand and design each inflection point in your startup. I’m really excited for this series and to share specific insights and anecdotes along the way.