If you’re new to this newsletter, click here to access the rest of my newsletter articles such as the “Why We Passed on this Startup” series, reflections on investing, and tactics on winning in the market. Now, onto today’s post!

Investor deal flow is unsearchable. And yet…

An investor’s job is not to invest in every deal but rather give themself the opportunity to invest in every deal.

On a recent Summer weekend, my family and I visited some friends at their cottage in Northern Wisconsin.

My two older boys had the opportunity to fish in the lake that was nestled near the cottage. My boys caught a few fish. Then, my son asked me, “Daddy, how many fish are in this lake?”

It was a great question with an unsearchable answer. We will never truly know how many fish are in the lake. Did my boys catch 2% of them, 47% of them, 80% of them, or 98% of them?

Investor deal flow is the same way. For an investor, there is no way to truly know how effectively they are indexing the startup opportunities in the market.

This market inefficiency is one part excruciatingly frustrating but on the other hand, represents a tremendous arbitrage opportunity.

✅ An investor’s job is not to invest in every deal but rather give themself the opportunity to invest in every deal. ✅

The Four Categories of Investor Deal Flow

✅ Startups that an investor..

…chooses to invest in.

…chooses to pass on.

...is aware of but doesn’t know about the fundraise, so they miss the opportunity to invest.

...is NOT aware of and discovers it after the round has closed, thus missing the opportunity to invest. ✅

Let’s go through some examples to see how this works in practice.

1) Startups that investors choose to invest in

Obviously, this category represents a small and selective minority of startups that an investor sees.

2) Startups that investors choose to pass on

This category represents the vast majority of startups that investor sees.

In the first two categories, the investor becomes aware of the startup and thus has the control to react to it. The investor has the control to say “yes” or “no.” The investor wants to their deal flow set to be in Category 1 and Category 2 as much as possible.

The next category, Category 3, is ripe with opportunity for both investors and startups.

3) When the investor is aware of the startup but doesn’t know about the fundraise, so they miss the opportunity to invest.

Category 3 represents a startup that an investor is aware of, but lost track of and/or the founder never followed up. So, the investor misses the startup’s fundraise and doesn’t realize it until it’s closed. Thus, both sides miss the opportunity come the funding round.

I’ll share a wild story that drove this home. I met a startup founder several years ago at a conference. The company was in the early stages, choosing to bootstrap and to not raise venture capital at that time. At that conference, there were other startups that were actively raising that I had to make near-term decisions on.

A a time in the more recent past, at the same conference, I met the founder again. This time, the founder had a co-founder that they brought to the meeting. The company had progressed significantly since my original meeting several years ago. I do not believe the company was fundraising at the time of my conversation. I remember thinking after the conversation, “Their traction is really solid. I’ll have to follow up with them.”

Guess what happened?

I met so many startups at that conference that I totally lost track of following up with this one.

Some time later, a news headline hit my LinkedIn feed - this startup had raised a venture round with participation from several VCs in the Midwest!

My reaction? “How did I miss this?”

I hurriedly messaged the founder, which resulted in the below LinkedIn message exchange.

I was frustrated, but only at myself. I lost track of it, and thus lost the opportunity to invest.

Certainly, the founders could have followed up with me after the conference, but they weren’t obligated to. We had met before, but it’s not their fault that I didn’t follow up on a good opportunity at the time. Clearly, when they closed their round, they were being opportunistic in the moment with other investors around the table.

If I had followed up after the conference, I could have better tracked the fundraise and if interested, we could have put ourselves in a position to be one of those investors at the table when the company put out the call to close.

Now, this isn’t to say that Tundra Angels would have invested in this startup. That’s not the point. The point is that we didn’t give ourselves the opportunity, the “at bat,” to potentially invest.

An investor’s job is not to invest in every deal but rather give themself the opportunity to invest in every deal.

4) When the investor is NOT aware of the startup and discovers it after the round has closed, thus missing the opportunity to invest.

The fourth category represents a startup that an investor is NOT aware of and the investor only discovers it after the round is either not taking in more capital or has closed. This category is inevitable can never be eliminated because of the nature of the startups and VC game.

One day, I was going through my email and checking LinkedIn when I saw this headline.

The article went on to detail how Kurt and Monika Roots of Bend Health in Madison, Wisconsin raised $32 million with participation from a Wisconsin investor, Wisconn Valley Venture Fund.

My reaction? “Where did this come from?”

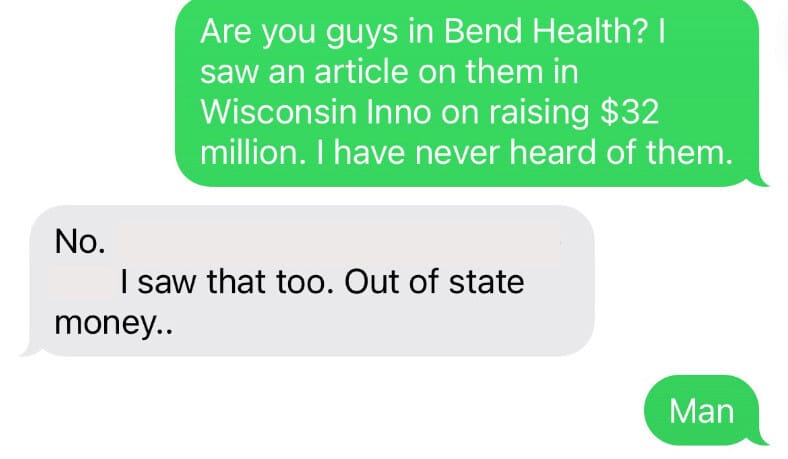

I texted a co-investor relationship that I figured would be closer to the action, resulting in this text exchange.

The 4th Category of deal flow feels like the rug got pulled out from under you.

Truthfully, as an angel investor network, it’s highly unlikely that we have invested in Bend Health in this massive round as the valuation was likely north of $100 million.

But when startups leap frog me or an investor like this, the 4th category of deal flow can make me or an investor question, “This is my whole job. If I missed this one, what else am I not seeing or missing?” If I’m being honest, on my bad days, it can make me feel introspective and question in self-pity, “Am I even good at this?”

But the truth is, the 4th Category of Deal Flow will always exist because investors cannot index the entire opportunity set.

Just as one cannot index how many fish are in a lake.

Deal Flow Functions as a Loop

To add a layer onto this, here is the rule about these 4 categories:

✅ Deal Flow Categories 1-3 are a loop and must constantly be maintained and nurtured.

Deal Flow Category 4 is independent and inevitable. ✅

See the graphic below:

Any new opportunity for an investor is “new deal flow.” It then becomes category one or two. Those two categories form “existing deal flow.” Importantly, Category 3 now becomes a potential outcome - startups where investors could be aware of but miss the fundraise, and thus miss the investment opportunity. With existing deal flow, it’s a continual loop.

In a perfect world, the existing deal flow always results in Category 1 and Category 2 and never Category 3. But it requires the investor to optimize that as best as one can.

Category 4 is a separate and inevitable reality of the venture capital game.

Recommendations:

My recommendation for both startups and investors is to stay top of mind with each other.

As much as sometimes startups and VCs are positioned as on opposite sides of the table, each side needs to work on creating opportunity for the other.

For startups, I’d recommend two tactics:

An ongoing monthly update

An individual email letting the investors on your distribution know that you have A) kicked off your round, B) are half-way through, or C) are finalizing your round.

I recommend sending a monthly investor update. I wrote about why monthly investor updates are a secret weapon for startup founders in this article.

In addition to monthly investor updates, I would have a process to individually email each investor that you have an active round in process over three points in time, A) Fundraise kick off, B) Half-way through, and C) Finalizing your round, regardless of whether or not they have passed on you or not.

An individual email is a lot more personal and comes across more high-touch. Sort of like, "Hey, this round is happening, and I thought of you." It shows the presence of mind of the founder and puts them in a positive light. It also provides a context for me as an investor to forward that email along to an investor in my network who may be interested, even though I am not!

I’ve found that founders don’t tend to do individual emails because they assume one of two things - Either, "That investor didn't seem interested, I guess I won't share with them about my round,” or, they don’t think to notify the investor.

An individual email across these three fundraise timestamps are a great opportunity because founders don't know if that investor may be interested. Or, if they know other investors that could be interested that they will introduce you to!

For investors, seeing the Four Categories of Deal Flow is the first step.

An investor’s opportunity is to optimize Category 3 to be as miniscule as possible.

I would encourage investors to find a process to stay on top of the new deal flow and existing deal flow. Every VC firm has a different workflow, process, etc. But fundamentally, it starts with indexing every opportunity that comes across your path whether in-person or in any online context. At a minimum, I would gather:

Founder Names

Company Names

Email Addresses

With that, you have a starting place to stay top of mind with the founders in your network.

Closing Thoughts:

Investors cannot index the entire set of deal flow opportunities.

An investor’s job is not to invest in every deal but rather give themself the opportunity to invest in every deal.

But within that, they must accept that Category 4 deal flow exists - that there will be startups that the investor is NOT aware of the startup and discovers it after the round has closed.

So, the goal of investors, as well as founders, should be to minimize Category 3 deal flow. The way that investors, and founders, can do that, is to stay top of mind with each other. In so doing, they give each other the opportunity.

Click here to access the rest of the newsletter articles.

Here are some of the recent ones!