In the last newsletter, I put forth the “Venture Investing Expression” below:

✅ Depth of market problem ∝ solution fit ∝ non-obvious insight ∝ traction ∝ business model ∝ market size ∝ go-to-market strategy ∝ team execution potential ∝ status of fundraise ∝ valuation ∝ stage of business ✅

The next item is traction. Traction, like the words “AI,” “innovation,” or “MVP,” have now been commoditized and no one is clear on exactly what it means anymore.

I want to try to help clarify this conundrum. But first, a bit of context.

Investing of any type contains risk. Investing theory states that for investors, there needs to be appropriate compensation for the risk taken in a given investment.

Startups are, by definition, high risk entities. Day One is the highest possible risk for a startup. Therefore, to account for compensating the early investors, that startup’s valuation today is lower than it would be, say, two years from now. Investors are compensated for the risk they take if they invest earlier in the startup's journey.

As startups build product, acquire customers, scale the product, add to the team, and raise additional capital, the startup’s valuation goes up. However, what’s fundamentally happening is that the startup is systematically lowering its risk over time. With the lowering risk profile, the valuation goes up.

Therefore, a startup should be systematically reducing and removing risk over time.

“Traction” is the word that we use to measure the degree to which the startup has de-risked itself over time.

✅ I think of every startup as a measure of risk. Specifically, there is risk across three dimensions - 1) Technical risk, 2) Market risk, and 3) Scale risk.

Technical risk is “Can this product, and therefore, the fundamental customer transaction, technically be achieved?”

Market risk is “Is there strong evidence that customers demand the product and are paying for it?”

Scale risk is “Can customers be acquired with high margins and low customer acquisition costs in a highly scalable way?” ✅

Thus, traction is the objective validation that a startup is moving from a position of high risk across either technical, market, or scale risk, to a position of lower risk in those same categories.

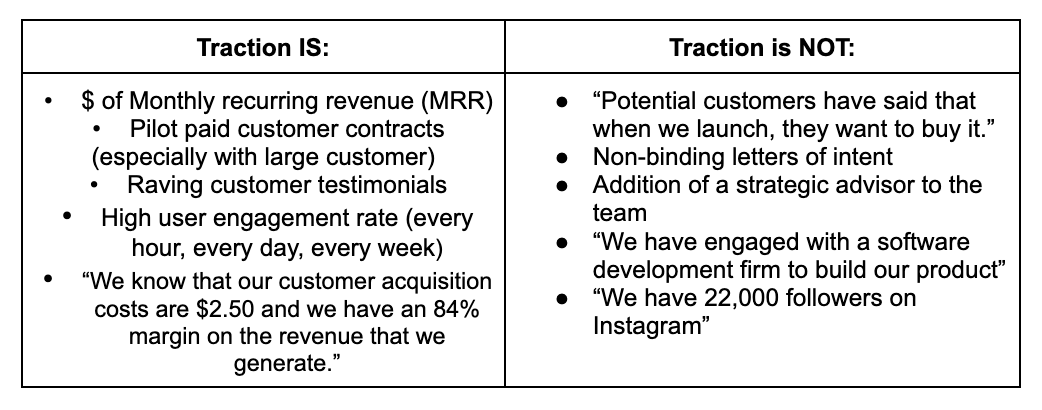

✅ Thus, the only thing I consider traction is notable achievements that display progress and that serves to reduce the startup’s risk in one of those three categories. Anything else is vanity metrics and activity without achievement. ✅

But just don’t take it from me. Gabriel Weinberg, author of the book, Traction, says,

What founders think is traction is oftentimes is not what investors see as traction. I want help you understand how I measure traction:

“How Much Traction is Enough?”

Startup founders often ask me, “What level of traction do you need in order for Tundra Angels to invest?”

I understand that they are hoping they are expecting an objective answer such as they need $6,000 MRR, or they need to be post-revenue, or they need to have 30 paying customers, etc.

But to flip this on it’s head, it’s almost like you’re asking the question to a person you want to date, “What do you need to see in me in order to date me?” Who does that? 🤣

It’s a largely unanswerable question. Also, every startup is different.

Traction is relative. Specifically, I have seen that traction is relative across factors such as 1) Investment firm, 2) The market/industry (how large the market your progress is in), 3) Business model (SaaS vs. marketplace vs. enterprise sale, etc. 4) Price or average contract value (ACV), and others.

“But, Really, How Much Traction is Enough?”

I want to try to be as helpful as possible to answer this question. Here are two quick hacks that I use to determine a quick read of the startup's traction.

First, I evaluate the startup’s market penetration to date.

I understand the total number of potential customers in the market (or could be sub-market or niche market) that the startup is attacking vs. how many customers it has brought in within that same denominator.

If the answer is the startup has 0.0012% of a market with thousands of customers, then that’s not interesting. If a startup has 80% of a market, even if that market is 100 customers, that’s a signal that something potentially interesting is happening.

For example, if there is a B2B marketplace startup that has 950 total users with $33,000 transactions processed thus far. Assuming a take rate of 15%, that would mean the startup’s revenue is $4,950. If the market for this is monumental, I might consider this to be still a high risk position given the low market risk. But we changed the scenery and those 950 users instead are part of a niche market, such as pediatric ER doctors across the country, which represents the startup’s beachhead market to eventually get to the mass healthcare market. In this case, everything changes. I now think that getting buy-in from 950 pediatric ER providers is highly meaningful relative to how many exist and shows that something is clearly working with this startup’s value proposition. In that case, that traction would be highly significant.

Secondly, I evaluate the startup’s price relative to the sales cycle which gives me a ballpark number of the number of customers that have meaningfully bought into the solution.

Secondly, I understand the price of the product relative to the typical sales cycle that would follow for such a price tag. If the price is low then typically the sales cycles is quite short, like days or weeks. In that case, the startup needs a lot of customers to show meaningful traction because there are a lot of customers who would spend a low dollar amount. If the price is tens of thousands a year, then logic would follow that the sales cycles are quite longer. In that scenario, you need a handful of customers to show traction.

The lower the price of your product, the more customers you need to show traction.

The higher the price of your product, the fewer customers you need to show traction.

For example, a startup selling an enterprise FinTech solution to enterprises at $100,000 ARR per contract needs a different level of customer traction than a startup selling B2B in the construction tech space which has an average contract value of $500/month.

If the FinTech startup had 2 contracts signed with enterprise customers ($200,000 ARR), I would evaluate that startup with a better traction profile and thus lower risk than the construction tech startup that has six customers at $3,000 MRR.

In closing, a startup should be systematically reducing and removing risk over time.

“Traction” is the word that we use to measure the degree to which the startup has de-risked itself over time.

Traction development is certainly not easy, but it's not as difficult as it's sometimes it is made out to be.

Pay attention to what achievements are traction-oriented and serve to reduce risk in the business. Execute on solely those items. Typically a founder’s plate is riddled with execution activities that truly do not reduce risk, and thus increase traction, at all.