In the last newsletter, I put forth the “Venture Investing Expression” below:

✅ Depth of market problem ∝ solution fit ∝ non-obvious insight ∝ traction ∝ business model ∝ market size ∝ go-to-market strategy ∝ team execution potential ∝ status of fundraise ∝ valuation ∝ stage of business ✅

The next one is Market Size.

When I hear VCs talk on a podcast or an interview, occasionally the interviewer asks the investor the uniformly general question of “What do you look for in startups before you invest?” One of the answers that the investor says is, “A big and growing market.” Whatever that means. 😂

When I hear and see founders speaking about market size, it tends to be in the Market Size slide of their deck. That’s where I often see founders go off the rails.

The confusion comes in that market size means different things to different people. Contrast two “market size” slides that I had in my own startup’s deck about 6 months apart from one another.

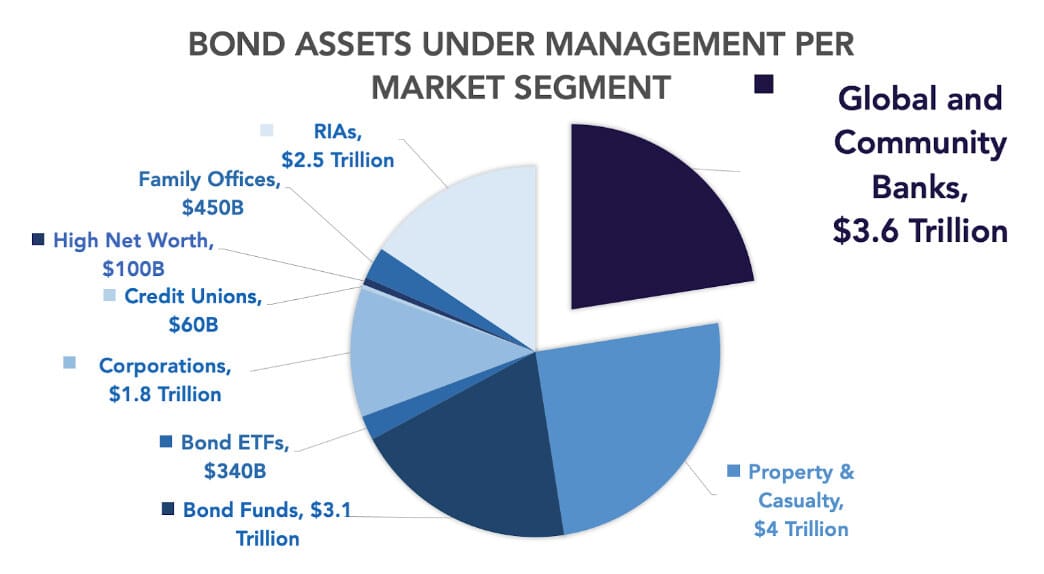

I did something incorrectly on the first graph in my deck. That’s not market size. It is the dollar amount of bonds under management at each of those firms. It’s not market size in the slightest. A advisor encouraged me to put that in. I didn't know any better as a newer startup founder 😞

In short, the market size that matters should be the total revenue potential that is possible for this startup. The calculation is the number of potential customers in a given market * the amount of revenue that the startup could generate, based on their pricing model.

In my example, the market size that matter is “the price of our software * the number of potential customers in the firms that trade bonds.” The second graph is the true market size as an investor would want to see it - the true amount of revenue potential that our startup could have gained, based on the number of customers and based on our revenue model.

How I Evaluate Markets as an Investor

First of all, I approach it in a binary way - is this a big enough opportunity that it makes sense from a venture investment perspective?

Generally, the rule of thumb that I use is that if the market is > $1 billion revenue potential, that’s large enough. If it’s in the hundreds of millions, more investigation is required to understand if it’s a large enough venture capital opportunity. Again, it may be a great opportunity for that company. But can investors make substantial money in that market?

As an aside, I personally don’t get caught up in TAM (total addressable market), SAM (serviceable addressable market), and SOM (serviceable obtainable market).

I don’t focus my energy much on this because just like financial projections, the #1 that we know about them is that it will be wrong. As a generalist investor who invests in lots of industries, I cannot vouch for whether these types of customer segments that the founder presents will be customers or not. In short, it’s hard to know that just because they are on the TAM, will they actually be a customer?

Thus, I try to get more tactical. I think about market size in two dimensions - horizontally and vertically.

Horizontal Analysis

✅ Market size for me is a market segmentation exercise. I am not overly concerned with one gigantic market. Rather, I focus my analysis on niche markets that the startup could take over on its path of domination to the larger market. My question is, where can this startup find a wedge and be incredibly successful very easily?

Thus, my mental model equation is:

“Revenue potential of a singular niche market (divided by) the # of startups (including startup in consideration) in that niche market ∝ (in proportion to) the likelihood for startup in consideration to attract market share away from alternatives (as measured by non-obvious insights, among other things).”

Vertical Analysis

My next question becomes, what are the big market opportunities that these niche markets could lead to unlocking over time?

✅ Specifically, I think about two scenarios:

Is there a path where I can envision winning 80%+ of the horizontal niche markets to the colossal market opportunities of the broader market?

If there is, what revenue numbers (ARR or MRR) could the startup have by the time they reach the mass market? <-- (that's where market size becomes helpful)

Or, is the niche and the mass market so diametrically different from one another that you cannot move the niche market to the mass market? ✅

If 1) is true, then it is an opportunity definitely worth investigating further. If 2) is true, it’s likely destined to be a small dollar opportunity and I need to make a call if we can get a meaningful exit by staying in the confines of that market or not.

I’ll share a tangible example. at one point, we were doing due diligence on a company. It was 100% clear that the TAM opportunity was massive yet wrought with many other similar direct and indirect competitors - a complete red ocean with blood in the water. Thus, I knew that to crack the TAM opportunity, the startup would need to capture customers in smaller niche markets. Over time, the startup identified a singular niche market with a hair on fire problem. The number of other startups in the space? Zero. Zilch. The startup was completely by itself in its own market. I calculated the total revenue potential by capturing sub-markets 1, 2, and 3, of this niche market. Let’s say for example it was $125M. That meant that a startup had access to own a $125M opportunity if it scaled quickly enough. It could then leverage those stepping stones of revenue to break into the broader TAM and leap frog the other competitors in that space who are in their foxholes fighting after the same market turf.

In closing, three thoughts.

First, be attentive to niche market opportunities where you are the only viable startup in that space offering the product or service. Calculate the revenue potential. If you are by yourself, you need to move fast before someone else enters that market.

Second, are you able to envision a path to leverage from the horizontal niche market to up the XY axis vertically into a broader market opportunity worth a lot more money?

Third, then, when you pitch and speak about market size, show two elements - the niche market opportunity revenue potential, and the total addressable market revenue potential. That way the investor can understand the micro to the macro opportunity for your startup.

With investors, it’s important to “show them the money” with the large numbers in the market you are in. But showing that you have a winning strategy to go capture 80% of that money is all together different. Speaking and pitching in terms of the horizontal niche market(s) and vertical mass market helps clarify not only the micro to macro market sizing but also that you are strategic about your plan for market domination. 🙌